Just because you get a good offer on a loan, it does not mean that you should jump on it immediately. It is always recommended that consumers shop around for the best loan rates. Today, we will discuss how this can be done effectively and save you some time. Check Interest Rates One of the… Read more

Viewing posts tagged with: loan

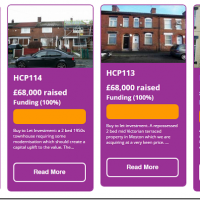

Real estate crowdfunding, the hassle free property investment

If there are two things we like here at The Savvy Scot, it is real estate and alternative investments. Remember that time when we talked about two couples taking a mortgage together to get a bigger house? Well today I would like to review another alternative way to invest in real estate: crowdfunding. Yes, just… Read more

How to keep your credit rating positive

If you’re a new, up-and-coming business it’s important that your credit rating is positive and clear of any misdemeanors to ensure you can obtain loans and help your growing enterprise excel. There are many ways to improve credit rating and just as many things you can do to tarnish your report. Steer clear of… Read more

Qualifying for a homeowner loan

Individuals who already own their property with a mortgage are normally eligible to apply for a homeowner loan. In this way, they can borrow extra money using their home as collateral against the loan. A secured loan (also referred to sometimes as a secured homeowner loan) lets you take out a loan which is… Read more

How to Fund Home Improvements

A recent survey by Lloyds TSB has suggested that the total spent by UK households on DIY has fallen to its lowest level since 2000, with more homeowners than ever resorting to a simple lick of paint or some new wallpaper to improve their home. An average British household now spends just £352 on home… Read more

Recovering from bad credit? Tips to get you back on track

Recovering from bad credit can be a long process. At times it may even seem like you’ll never break out of the rut … but there are ways of securing your place in the black and out of the red. Here’s how. Get reviews from credit bureaus When you receive the review make sure the… Read more

Your Options When Short on Money

Many members of society find themselves in emergent situations without the funds to satisfy the need. While these people feel stuck or at a loss as to how to get the money they need, they fail to realize the options right in front of them. There are options for everyone, even those with bad… Read more

4 things to consider before buying a house on your own

I own a property in the UK that I bought alone a few years ago. Even though I had a boyfriend at the time, he had no interest in co-signing and I didn’t have much interest in getting him on board. Not that I didn’t love him at the time, but I knew it was… Read more

The Basics of Renting Your Property

Renting your property is a viable alternative to selling. This way, you’ll get a consistent stream of income and you’ll still have the option of selling when the time’s right. If you weren’t considering the idea, though, you’ll have a few questions. Take a look at this guide for all the basics you’ll need to… Read more

Cutting the cost of car ownership

Cars are among the most useful things you can own, but they also account for some of the biggest expenses a household will face. There are, however, a number of steps you can take to cut the cost of car ownership significantly. Obviously, these will not completely eliminate expense, but they will often make it… Read more

New social media advertising guidelines for payday lenders

Following a raft of recent regulatory reforms and proposals, the Financial Conduct Authority has been cracking the whip once more, this time turning their attention towards the consumer credit industry’s use of social media to advertise their products. Much has changed since April 1, when the Financial Conduct Authority (FCA) began its regulatory regime…. Read more

Have a student loan debt? Consider debt consolidation

Imagesource.com Rising inflation has affected all aspects of our daily lives, from higher mortgage rates to a rise in the cost of living. Unfortunately it has also lead to rise in areas like education, which many believe should be free. The cost factor has made it very difficult for students to receive top quality… Read more