Getting on to the property ladder is a big decision. First-time buyers face a lot of stress and work, from meeting with banks, brokers and advisers and working out the true costs of buying a house to viewing properties and enduring sleepless nights as they wait to hear whether their offer has been accepted. But… Read more

Viewing category: Personal Finance

5 Reasons Regular Financial Check-Ups are Important

Every six months or so, I used to go to the dentist for a check-up. Since moving out of home to University, the check-ups became less and less frequent – realistically becoming annual check-ups. Unfortunately since graduating and moving to London a couple of years ago I am ashamed to admit I haven’t visited a… Read more

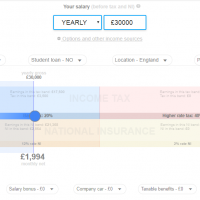

It’s a New Tax Year – Time to sort out your finances!

If you didn’t quite stick to your New Year’s resolution to sort out your finances, the good news is that you’ve been given a second chance. The 6th of April heralded the start of the new tax year, meaning you have another shot at organising your money, sorting out your credit cards and getting a… Read more

7 Effective Ways to Stretch Your Meal Money

Now that the holidays are behind us many people will be trying to tighten their belts – in more ways than one. Diets will begin as we all try to shed those extra pounds gained by overindulging in rich, decadent foods. At the same time, holiday spending guilt will no doubt force others to slash… Read more

Items You May Forget To Include In Your Budget

You wouldn’t forget to include your rent or car payment in your budget, but chances are you are forgetting one of these items. These irregular payments can often be overlooked. While it may not be a big issue to work it into a budget for some, it could be a major inconvenience for others. Be… Read more

Why you need to fix your credit NOW

They say the best time to plant a tree was 20 years ago, and the next best time is now. The same goes for your credit score. I know, it’s annoying, and it can be tedious to look into years of financial data, and find out why your credit score is low. But it is… Read more

How to Earn (and Save) on a No-Income Budget

If you’re out of work right now, you aren’t alone. Millions of Americans have had their lives and livelihoods upended by COVID-19. But just because you don’t have an active income doesn’t mean you can’t benefit from a budget: In fact, it’s even more important to have a financial game plan in place as you… Read more

Planning for a great financial future

As we have discussed previously around here, planning for your future financially is the best way to succeed. For example, when you set up some saving goals, and have a direct debit on pay day taking that money right out of your current account to place it into savings, you don’t miss the money, and… Read more

The Deadly Cost of Not Having a Will

An important part of managing our assets includes creating a will. Death isn’t something we want to think about, but it’s going to happen to us all. Having a will in place helps safeguard our desires upon death. Keep in mind that certain places may have laws in place regarding those who die without… Read more

The Lifetime ISA Explained

On April 6th, the start of the new financial year, a new ISA class was born. The Lifetime ISA, known as the LISA has been launched to help first time buyers and retirees save up for life’s uncertainties. A replacement for the Help-to-Buy ISA, the LISA allows for tax-free returns on deposits up to £4,000…. Read more

How You Can Save Money On Healthcare

One benefit of living in the UK is the National Health Service, a public health service which provides free healthcare to UK citizens. While this covers the majority of a person’s healthcare needs, according to the Office for National Statistics, the average UK person spends around £2,000 on healthcare every year; a number that is… Read more

SavvyScot Special: Get £10 Cashback when you switch energy provider

Scroll down for details about our exclusive £10 cashback offer on your next energy switch! Are you paying too much in utilities? When was the last time you did a comparison search to make sure you are on the lowest tariff? Utility companies generally offer a very attractive rate to new customers for the first… Read more