You really shouldn’t trust strangers in money related issues, especially when your own wealth is involved. But undeniably wealth management is necessary and you might just not know all there is to properly invest. So financial advisors are necessary and they will not “steal” your cash (unless they are con-men) par say, but they might… Read more

Low Cost, High Volume: Top Android Apps for Penny Stock Traders

Investors like to invest in penny stocks because of the possibilities that can occur in such a short time frame. At such low numbers there is the possibility for the stock to make massive gains. On the other end of the spectrum is the ability to lose massively as well. That is why it is… Read more

The cost of living compared between countries

Have you ever wondered what it costs to buy one same item around the world? When I was living in London, I often cringed at the high prices of everything, but on the plus side, traveling abroad seemed very affordable. Research from 247Moneybox.com shows that there are indeed places on Earth that are even dearer… Read more

The Earth Awaits: Discover Amazing Places to Retire

This is a guest post from The Frugal Vagabond, a personal finance blogger and software engineer living in the San Francisco Bay Area of California. He writes about personal finance, travel hacking, and early retirement, and is always looking for new and creative ways to live a life of his own design. He can be… Read more

Could A Better Car Improve Your Ride Sharing Sales?

There’s a lot of full-time drivers making a living off all the riding sharing apps that have popped up in the past few years. It’s a legitimate business with a lot of room to grow, which means being a professional rideshare driver is likely to get a lot more competitive. But if you start early… Read more

Is Living in the Country the Right Financial Move for You?

I grew up on a farm in a very rural location. We had livestock, farmland and our closest neighbor was barely within walking distance. What a change from the city life that most people experience in the 21st century. After graduating high school, I moved to a city to go to college. I later… Read more

How to Get Your Car to 500,000 Kilometers

The last car I owned had nearly 500k KM when I stopped driving it. The only reason I’m not still driving it is because I was side swiped while passing through an intersection. And actually, the car still ran fine. But the insurance paid a lot more than the car was worth so I let… Read more

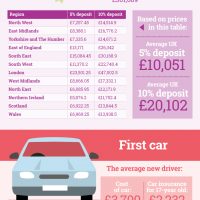

Are you Saving Enough for your Child’s Future?

What kind of future do you visualise for your child? Do you hope they will learn to drive and buy a car, go to university, get married, and buy their own home? How often do you think about how much these things cost? As a parent, you might put money aside every month in… Read more

10 “Bad” Money Habits and How to Get Rid of Them

One of the things that make bad money habits hard to break is that we don’t even recognize we have them in the first place. Just as with any other issue we may have in life, the first step to start improving it is to spot it and then turn it around. These 10 bad… Read more

5 Ways Home Ownership Can Help You in Retirement

Among Millennials, home ownership has declined to historic lows, and with good reason: crippling debt, a high cost of living, and skepticism about the American dream all conspire to reduce young people’s commitment to home ownership. Their parents might even begin to wonder if Millennials are onto something, but home ownership remains a savvy… Read more

When Is Enough (Spending) Enough?

I recently read an article about someone who became a decamillionaire overnight. Now, of course he worked for years to get to that point. But he didn’t make much money at all. Then, another company bought his project – for over $10,000,000 (£6,957,804.40). He went from being near the poverty line to being very rich…. Read more

Ways in Which You Can Pay Off a Payday Loan

Payday loans are usually temporary, short-term loans (advances to be technically correct) to help you deal with a short-term financial crisis. They are usually expected to be paid off within a fortnight, or on your next payday or as per the agreement. But, they are usually unsecured and so that rate of interest tends to… Read more