This post was written in collaboration with the Bank of Scotland One thing we strive for day in and day out at The Savvy Scot is to help you save money. And often, we find out readers forget about the big pictures. Sure, it is great to stop buying clothes for a month, it may… Read more

Viewing posts tagged with: mortgage

Retirement Pitfalls & How To Avoid Them

Everyone knows that, however much we plan for the future, things will inevitably occur that upset our carefully worked out strategies. The trick here is not to fall into the trap of thinking that there’s no point planning! However close or far away to retirement you are, there are pitfalls to avoid and positive… Read more

What are the consequences of not having life cover to protect your mortgage

If you have dependents, whether that’s a spouse, partner and or children, the consequences of death without having life cover in place to protect the repayment of a mortgage can be catastrophic. Let’s just imagine the scenario for a moment of what might be a typical family. David and Claire have two children, Tom… Read more

Is right now the best time to get your first time buyer mortgage?

Once you finally make it onto the property ladder, you complete a life goal. And you deject the anxiety that comes with ‘wishing for what could be’. It’s tough, before that first step. You feel the days tick away. Your colleagues share their housewarming photos on Facebook. And you become all too aware of how… Read more

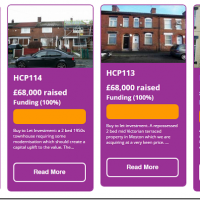

Real estate crowdfunding, the hassle free property investment

If there are two things we like here at The Savvy Scot, it is real estate and alternative investments. Remember that time when we talked about two couples taking a mortgage together to get a bigger house? Well today I would like to review another alternative way to invest in real estate: crowdfunding. Yes, just… Read more

New year financial boot camp: refinance your mortgage

Are you ready to kick start the new year with a bang? To help you do just that, I have put together a month long financial boot camp, with two tips per week and a call to action. Together, we will review several aspects of your financial life to make sure you start the year… Read more

Paying off your mortgage early is easier than you think

Five years, ago, I took out my very first mortgage and bought a three bed flat over the next thirty years. Interest rates were low, so I opted for an index tracker that hasn’t moved since. One of my favourite features about that mortgage is the ability to make small repayments whenever you feel like… Read more

Qualifying for a homeowner loan

Individuals who already own their property with a mortgage are normally eligible to apply for a homeowner loan. In this way, they can borrow extra money using their home as collateral against the loan. A secured loan (also referred to sometimes as a secured homeowner loan) lets you take out a loan which is… Read more

4 things to consider before buying a house on your own

I own a property in the UK that I bought alone a few years ago. Even though I had a boyfriend at the time, he had no interest in co-signing and I didn’t have much interest in getting him on board. Not that I didn’t love him at the time, but I knew it was… Read more

The Basics of Renting Your Property

Renting your property is a viable alternative to selling. This way, you’ll get a consistent stream of income and you’ll still have the option of selling when the time’s right. If you weren’t considering the idea, though, you’ll have a few questions. Take a look at this guide for all the basics you’ll need to… Read more

Insolvency declines in Scotland

We often talk about debt management around here, and how your debt should be your number one target to crush before you tackle any other financial goals. Well good news, people having to resort to bankruptcy have declined lately, showing a more responsible approach to debt and better financial management. Protected trust deeds are available to… Read more

4 Challenges You Face If You Have Bad Credit

If you are one of the many people who suffer from bad credit then this article probably won’t surprise you. Still it’s important to note the many extra challenges you will have when you have a bad credit history as opposed to people who have average or excellent credit. First, you will have to pay… Read more