What do you imagine when you think about the future of credit cards, or payment methods in general? I remember when flashing a code with your smart phone was considered an odd occurrence you would only see in Japan or South Korea, and yet now it allows you to pay for some products directly with… Read more

Just a few days left to use your ISA allowance!

We will be short and sweet today, with a friendly reminder that the tax year in the UK is coming to an end on April 5th, so you only have a few days left to use up your ISA allowance. What is an ISA? For those of you who are not familiar with the Individual… Read more

How to Know if An Office Space is Perfect for Your Business

Finding an office space is one of the most difficult things to do these days especially when you are very mindful of your budget. There may be a lot of office spaces in Sydney but you have to be discerning as to the place that you will choose as it can have a huge impact… Read more

Top 10 mistakes traders make when filing their taxes

April 15th – the day that makes most of us shudder. Dealing with taxes can be a complicated process for the average person, but investors have an even trickier time staying in compliance with the IRS tax code. While online programs like TurboTax, for example, might be a good fit for someone with straightforward financials, traders… Read more

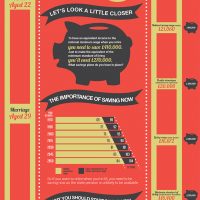

Are you a life saver?

Hi there! Today I wanted to share with you this infographic from AJ Bell Youinvest, as it is a perfect follow up of my lifetime of savings series, where we talk about why you should save and invest money and how to do it specifically in your 20s, 30s, 40s and 50s. I can’t empathize… Read more

Teenage money, how to help without spoiling

You want the best for your kids, and that is all in your honor. You want them to be spared from the world, to grow without worries about anything, while at the same time preparing them for the responsibilities they will have to face as adults. And that is a very tough job, helping without… Read more

Paris restricts driving, could you live without a car?

For the first time since 1997, the city of Paris is limiting car circulation to try to get rid of a big smog cloud that has been looming over the city for too long. According to Reuters, the pollution levels are very high, the European Environment Agency (EEA) reported147 microgrammes of particulate matter (PM) per… Read more

How To Cut Cost On Your Monthly Expenditure This Year

You might want to save up for a special holiday, a revamp of your home, or you might just want to save a little extra for a rainy day. Whatever you reason, the best way to add up the pounds and pennies is to cut back on your monthly expenses over the course… Read more

How does the Help to Buy scheme work?

Have you ever heard about the help to buy scheme? It is a government backed project that helps people buy a home. It divides in two categories, the equity loan and the mortgage guarantee. The folks at Barratt Homes have put together a nice infographic to help you understand everything better. Basically, you can get… Read more

A guide to being smart about selling structured settlements

For most people, momentous events such as starting a business or buying a new home is considered as their life’s aim as per National funding Resources Associates. If you are also one of them or are planning to start a new business, then your current annuity payments might not be sufficient to fulfill your… Read more

Savings and debt before marriage: Whose money is this?

For the past few years, most of my friends have been getting married or moving in with significant others, and oftentimes the question arises: when it is time to merge your finances, what do you do about the money you had before you knew each other? I will admit straight away that I am… Read more

Should you get renter’s insurance?

Living in a rental home or apartment may have you feeling relatively secure with your living conditions. Since you’re not the owner, there’s no worrying about fixing major property damage. Therefore, you may have never given much thought to renters’ insurance. However, you may want to reconsider and give this type of insurance serious… Read more