Ever feel like you are one paycheck away from a financial disaster? According to statistics, more than 10 million UK citizens have less than £100 in savings and the majority of citizens have less than £1,000. It’s no wonder that so many are one paycheck away from a disaster with so little in savings…. Read more

Viewing posts tagged with: savings

The savings culture and percentage of saving, around the world

Saving is a crucial part of our financial life. We spend over 1/3rd the time of our adulthood to grow profits. But times will come when we can’t work hard and we need to save up money. Though this is a very clear idea, not all people save equally. Some save more while others don’t… Read more

Why looking for the best savings deal simply isn’t enough

You’ve worked hard and you’ve saved some money, and now you’re looking for the best way to make that money work hard for you. Unfortunately it’s not a saver’s market right now. Interest rates are at a record low of 0.25% and there’s little sign of them rising anytime soon. This means you’ve got… Read more

Why You Should Prioritise Saving, Even When It Seems Impossible

It’s difficult enough trying to juggle your household budget, pay the rent on time and afford both the new shoes you absolutely need and a drink after work, without worrying about saving as well. After all, later in your career you’ll be paid better and can consider financial planning then. Actually, it’s always wise to… Read more

Unemployed people have more disposable income than zero-hour and part-time workers

We have talked previously about how disposable income, which is basically the money you have left at the end of the month, after all your bills are paid, is on the rise in the UK. More than a good news about the state of the economy, I think it may reflect more that people… Read more

Enrolling In The Thrift Savings Plan

Hello everyone, please help me welcome Marvin from www.brickbybrickinvesting.com and www.tspinvesting.com. You can connect with him on social media: Twitter | Facebook | Google + | LinkedIn. Many people have a lot of concerns about saving enough money for retirement, especially given the current state of the economy and the issues with various pension plans. In truth, the very things that most people once… Read more

Introducing peer to peer New ISAs

Are you familiar with the new ISAs? They launched back in July 2014, and just like the “old” Individual Savings Account, they allow you to save money tax free, in the form or cash, or stocks and shares. The big changes of the New ISAs were a huge increase in the yearly allowance, to £15,000 per… Read more

UK disposable incomes are on the rise

There was an interesting press release a couple of days ago over at Scottish Friendly, talking about the UK’s disposable incomes. Well good news, Britons have seen a 3% rise in their disposable income over the last quarter. What is your disposable income? Simply put, it is the money you have left at the… Read more

Savings and debt before marriage: Whose money is this?

For the past few years, most of my friends have been getting married or moving in with significant others, and oftentimes the question arises: when it is time to merge your finances, what do you do about the money you had before you knew each other? I will admit straight away that I am… Read more

A lifetime of savings part 1: Saving money in your 20s

Hi there! Today I want to talk about savings, as the eligible age for state pensions is getting pushed further and further, it is likely that by the time a 20-something retires, there is not much left for grabs. So it is your responsibility to plan for a financially comfortable future, and it starts now…. Read more

Choosing the best credit card for you

Wherever you are in your financial journey, at the very beginning trying to pay off debt or closer to financial freedom trying to maximize the rewards on your card, it is important that you choose said card carefully. Many sites today help you compare the cards and their different features, like Totally Money. Generally, there… Read more

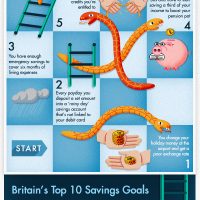

Savings Snakes and Ladders

I always LOVED snakes & ladders as a kid and today I have one in the form of a savings game! Infographic brought to you by Zopa!