Startup business owners cannot be expected to have a comprehensive knowledge of the rules guiding tax and NI. However, as one, you are subject to a wide array of taxes, including corporation tax and National Insurance. Here’s a brief overview of the main taxes you can expect as a UK startup owner, and useful ideas… Read more

Viewing posts tagged with: UK

Pawnbroking in the UK

Over the years, pawnbroking in the UK has emerged as one of the quickest, safest and most affordable way to secure loans. Not only are the interest rates extremely affordable, but it is possible for borrowers to receive a loan within 24 working hours without undergoing a lengthy credit check. Minimal Liability That said, many… Read more

Unemployed people have more disposable income than zero-hour and part-time workers

We have talked previously about how disposable income, which is basically the money you have left at the end of the month, after all your bills are paid, is on the rise in the UK. More than a good news about the state of the economy, I think it may reflect more that people… Read more

How much do you know about financial fundamentals? Take this US vs UK quiz!

If you read personal finance blogs like this one, you are probably way better about money than the average person. I am always amazed at how sometimes, I will talk to someone about simple money topics, like if they have a budget, if they carry a balance on their credit card, or if they… Read more

Beware of financial scams

I consider myself a pretty cautious person, when it comes to handling my finances and trying to keep my money safe. So you may be surprised to hear that I have been the victim of a few financial scams in spite of my caution. And even though I would never send my financial details… Read more

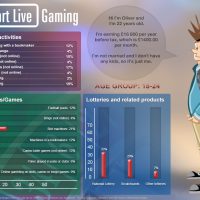

Betting behaviour in the UK

I have always had a mixed relationship with gambling. On one hand, I really enjoy the thrill associated with it when I am in a social setting, but on the other side, I am a pretty sore loser and I dislike seeing my money disappearing before my eyes. My uncle was the first to ever… Read more

Help to Buy: did you know about Mortgage Guarantees and Equity Loans?

Many people are struggling to see how they might ever take that first step onto the property ladder, or move their growing family into a bigger home. With house prices rising, the government’s Help to Buy scheme aims to bridge the gap between a bullish property market and buyers who have been outpaced by the… Read more

UK disposable incomes are on the rise

There was an interesting press release a couple of days ago over at Scottish Friendly, talking about the UK’s disposable incomes. Well good news, Britons have seen a 3% rise in their disposable income over the last quarter. What is your disposable income? Simply put, it is the money you have left at the… Read more

People are less financially comfortable after the age of 34

A new measure of consumers’ financial comfort has found that 34-year old men are the most comfortable in the UK with those in their 70’s the least comfortable. The study,commissioned by Hitachi Personal Finance and co-authored by Peter Grindrod, professor of Mathematics at the University of Oxford , combines economic data with research… Read more

London rents are so high it is cheaper to commute from… Barcelona

I read an article recently in the Daily Mail that covered the story of a young professional who ran the numbers and concluded it was cheaper for him to live in sunny Barcelona and take a FLIGHT to work four days a week than it was to rent a one bed flat in London! … Read more

UK – Falling Out of Love and Falling Into Debt

The following guest post describes the horrendous situation that debt is causing people in the UK to get into and some of the severe personal consequences that are associated with this. Borrowing up to twice the amount of our western European counterparts, a report has found that up to 25 people every day in the… Read more