On April 6th, the start of the new financial year, a new ISA class was born. The Lifetime ISA, known as the LISA has been launched to help first time buyers and retirees save up for life’s uncertainties.

A replacement for the Help-to-Buy ISA, the LISA allows for tax-free returns on deposits up to £4,000. Where it really stands out however, is that the government will also match your deposit up to 25%, meaning you could get up to £1,000 on top of your deposit – and get returns on the whole amount.

Available for savers between the ages of 18 and 40, the LISA allows you to get a 25% match of your investment every year until the age of 50 years old. So long as you keep your money in the ISA until you’re 60, unless you’re withdrawing to fund a first home, you’ll continue to get the reward.

That said, those that withdraw for other means will be liable for a 25% penalty on the whole amount, which could render the ISA pointless. Therefore it may be said that the ISA is ideal for use as part of a long-term pension strategy so long as you know the risks.

As the government’s auto-enrolment pension scheme also offers a good return for pension savers and is more stable, it may be worth considering the LISA as just part of your pension plan, rather than the entirety of it.

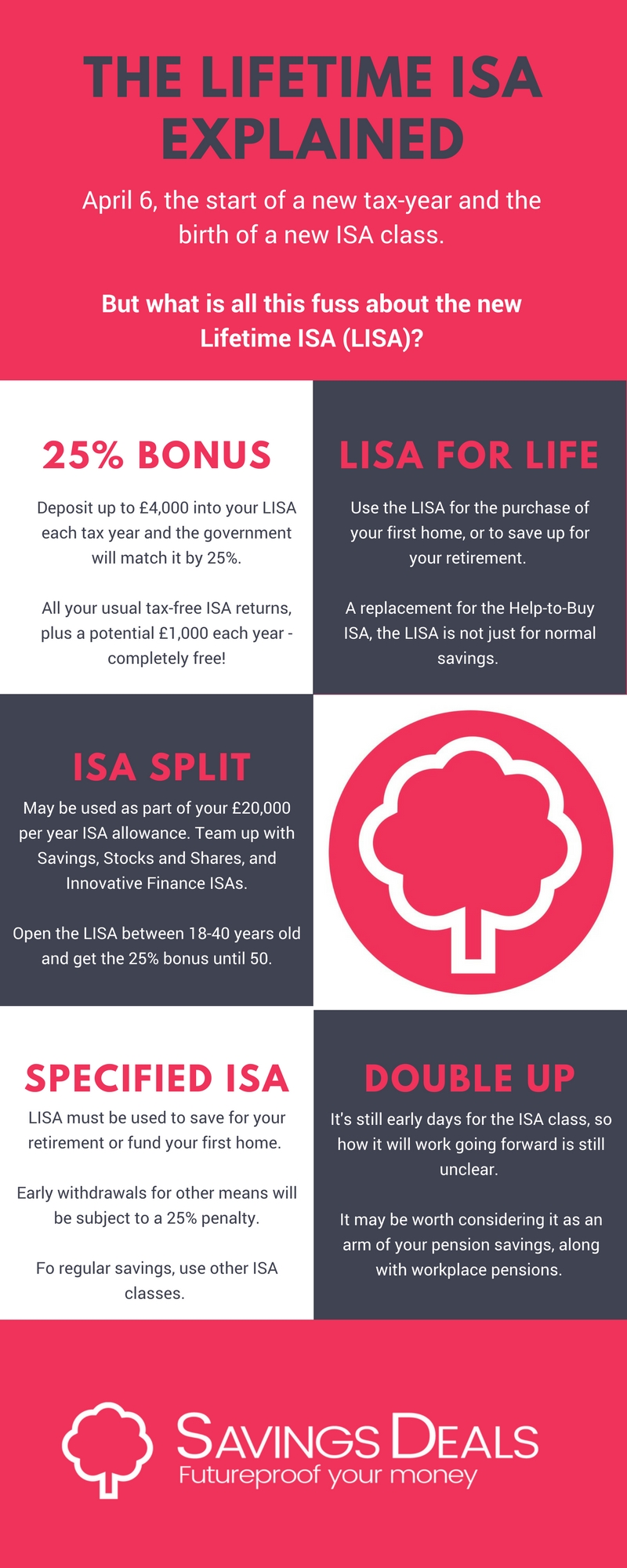

Check out this infographic for more information! (courtesy of Savings Deals, click on the infographic to visit their site!)