As we have discussed previously around here, planning for your future financially is the best way to succeed.

For example, when you set up some saving goals, and have a direct debit on pay day taking that money right out of your current account to place it into savings, you don’t miss the money, and your mind gets tricked into thinking it was never there in the first place.

Which is much easier than going all month with the temptation of a higher balance, and hoping you will have the strength to keep enough to save at the end of the month.

While I am not a fan of budgets and spreadsheets, which can often be limiting (how can you blame yourself for overspending £3 on hygiene while under spending £3 on groceries deserves a pat on the back?) knowing the general direction of where you want to be in a year, five or by retirement age is super important.

Enter calculators.

A regular savings calculator will tell you in just a few clicks how much you need to save every month if you want to retire a millionaire in 30 years.

A mortgage over payment calculator will figure out how much money you would save in interest if you were to put an extra £50 towards your mortgage every month.

And you can use a tax calculator tool to know what your payslip will look like with the new tax year. A tax calculator comes in handy when you set up all your different savings goals. If you don’t know what your after tax salary is going to be, you might be too ambitious with your savings, and feel frustrated with a tight budget.

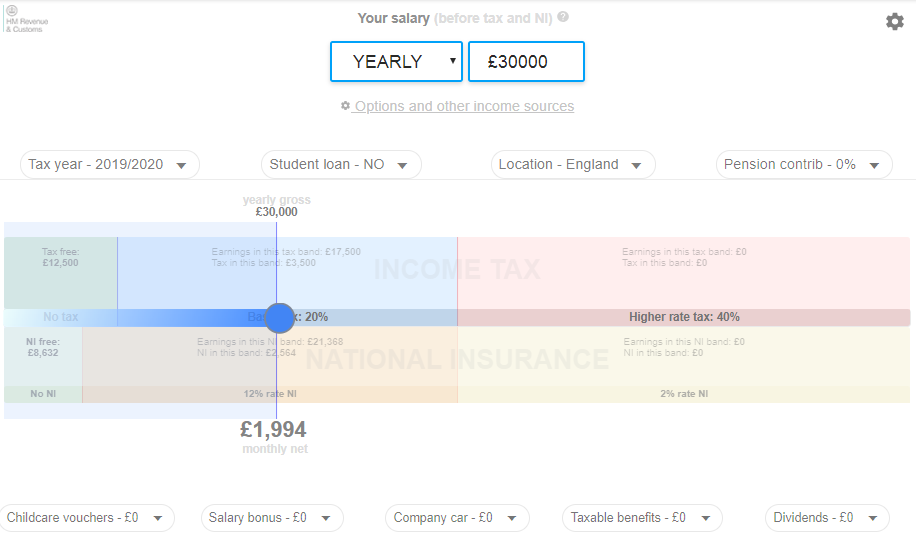

And there are different factors you can input into the tax calculator to make it as accurate as possible.

First, your yearly salary, before tax and National Insurance. Then, the current tax year which will determine your tax free allowance and a number of variables. Whether you are repaying student loans, your location, pension contributions, bonuses and other benefits will also affect your net income.

Using the tax calculator for a £30,000 yearly salary in England gives us the following results:

- £1,994 monthly net after taxes

- £12,500 tax free allowance

- £17,500 taxed at 20%

- £8,632 NI free allowance

- £21,368 at the 12% NI band

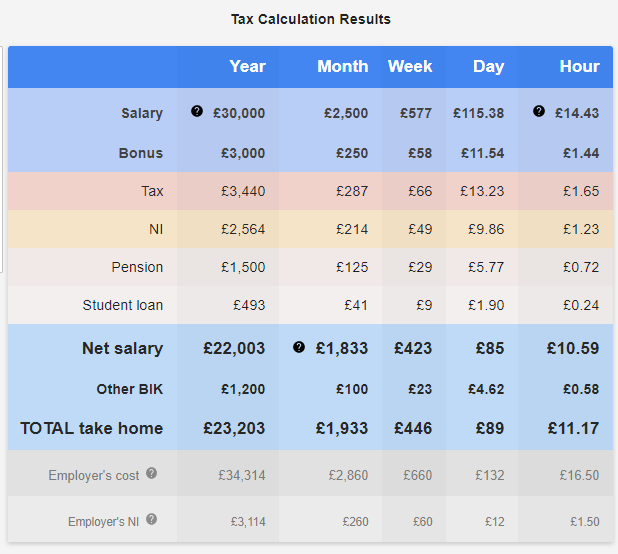

Now if we use the same £30,000 salary, say it comprises of a £3,000 bonus, we decide to make 5% pension contributions, and receive £1,200 of taxable benefits in kind, we get:

- £1,833 net salary

- £3,440 in taxes thanks to a £300 pension tax relief

- And the same NI contributions

A £160 difference in salary may not look like much, but it can pay your council tax! And if you were expecting the bigger payslip and received the latter, you may risk a costly overdraft. Hence the importance of using a tax calculator for your specific situation.

This tax calculator goes the extra mile in showing you how much you really made per hour.

In our second example, with £30,000 in base salary, we have made £11.17 an hour (including benefits in kind), and £10.59 net.

That means if you spend £300 a month to commute to work, and another £10 on lunch, you have worked two hours just to cover the cost of going to work. You would be going home with just six hours worth.

Every time you spend £10 at the pub after work, that’s another hour gone. Which is why a tax calculator can help you plan for your future. Every time you spend on something, ask yourself “how many hours of after tax income did it cost”?