According to a recent workplace wellbeing survey, a sizeable minority (39%) of employees globally feel that their work and personal life isn’t all it should be. Another survey also states that a whopping 94% of managers work longer than their contracted hours1. Being a manager of course often means staying late, tapping away at a… Read more

Five ways to a more environmentally friendly business

These days, many businesses choose to become greener, not only for environmental purposes, but also to differentiate themselves from their competitors, and offer their customers a greener option. While some green alternatives are actually more expensive, but can result in an increase in business, attracting customers who would otherwise not consider your product, there are also… Read more

For Money or Love: When Making Important Financial (or Other) Decisions, Don’t Let Emotions Rule

Sometimes it’s far wiser to lead with your head rather than your heart, particularly when it comes to important life decisions. That’s a lesson many people learn the hard way. Most of us have made decisions that were based primarily on our emotions at the moment, rather than on careful consideration of what is… Read more

How to Become a Gym Instructor

The fitness industry in the UK continues to go from strength to strength. With private health clubs and council facilities boasting over 8m members, not to mention the mega-rich clothing manufacturers and sports supplement providers, it’s little wonder this thriving industry has a market value of £4.3bn … … and it’s an industry that keeps… Read more

Money Saving Budgeting Tips for Young Families

If you’re a couple with a young children, you’ll be able to appreciate that the costs involved in raising them can be expensive. Naturally, you’ll want the best for your children and will try your hardest to give them a comfortable and nurturing childhood, but sometimes we can struggle to do this financially. There are… Read more

A Lot of People Need Investment 101

Polls of adults all over the world reveal that people have all kinds of perceptions about what makes the best investment strategy. Using a recent poll by Lottosend, we can make some general observations about what people think about investment, though we’ll have to guess about why. Here are some takeaways from this interesting… Read more

5 Scenarios When Buying is Better than Renting

Good morning everyone! I have a guest post over at Reach Financial Independence, Connie from Savvy With Saving will discuss the 5 Scenarios When Buying is Better than Renting. Click here to read more..

5 steps to cheaper a mobile phone contract

Mobile phones may be must-have accessories but no one wants to pay over the odds for a contract. Scarily, new research from consumer watchdog, Which? has revealed that 75% of us are doing just that – and it’s collectively costing Brits £5.4 billion a year. Ouch. Luckily there’s lots you can do to put things… Read more

5 Lessons learned from buying a car with bad credit

Buying a car can be stressful even for those who are fortunate enough to be able to buy outright, but if your only option is to finance the purchase and you have bad credit, it can feel like you’re trying to break down a 10ft brick wall with your bare hands. However, having had the… Read more

Spending Money to Make Money: Getting the Most From Rewards Cards

Credit cards are for spending money — or at least, that’s what lenders want you to believe. In truth, there are a variety of ways you can take advantage of credit cards to earn back what you have spent. Nearly every credit card issuer offers at least one card that boasts rewards. Rewards cards allow… Read more

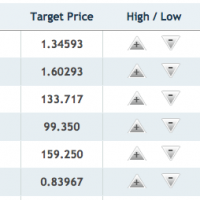

Investing 101: What Are Your Investment Options?

The first step in becoming a successful investor is taking the time to understand the markets and the different types of investment options that are available. There is an element of risk in every form of investment – just as there is in virtually every decision we make in life. Even a basic understanding of… Read more

What are the consequences of not having life cover to protect your mortgage

If you have dependents, whether that’s a spouse, partner and or children, the consequences of death without having life cover in place to protect the repayment of a mortgage can be catastrophic. Let’s just imagine the scenario for a moment of what might be a typical family. David and Claire have two children, Tom… Read more