It turns out that a personalised license plate isn’t just for the show offs, it can also be for the savvy. A personalised registration can work as a sound investment. As trends ebb and flow so too does the value of a license plate. A simple 1D plate warranted £352,000 when sold in 2009 at… Read more

Viewing category: Money

Alternative Ways to Finance London Student Living Costs

With the always rising cost of tuition and other related costs, it is getting more and more expensive to get a degree. If you are familiar with the archives of Savvy Scot, you know I always strongly recommend to run the numbers before getting into several years of negative cash flow in pursuing advanced education. In general,… Read more

Funding retirement debate on new pension rules

In case you haven’t heard, the pension reform will roll in from April 2015, and change quite a bit about the way you can fund and use your pension. On April 2015, people over 55 will be able to access their pensions freely as long as they pay income tax, instead of receiving an annuity…. Read more

Thoughts before buying a new car

A few months back, I went to the border to import a new to me car. It is a cute 2006 Hyundai Tucson with over 140,000 miles. When I bought it at an auction site, only one other bidder seemed to have a small interest in it, most people where bidding on two year old cars… Read more

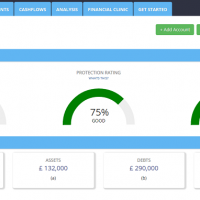

Take control of your finances in the new year with uMoneyBook

Can you believe there are only two weeks left in 2014? I know, me neither. And with the new year, comes the perfect time to take care of your finances! That means cleaning up your financial house, and setting goals for the year to come. And there is a perfect tool to help you do… Read more

Why do people choose secured loans

Loans secured against assets are a popular choice for people who may find it difficult to obtain other types of products or for those who want access to larger amounts of money or longer repayment periods. They usually offer better rates than unsecured loans but do require people to have assets, such as their… Read more

Unemployed people have more disposable income than zero-hour and part-time workers

We have talked previously about how disposable income, which is basically the money you have left at the end of the month, after all your bills are paid, is on the rise in the UK. More than a good news about the state of the economy, I think it may reflect more that people… Read more

Fighting fraud this Christmas

The festive season is now well and truly underway. The Christmas decorations have gone up, advent calendars are being opened and your friends and family’s Christmas wish lists have started flooding in. With just weeks to go, it’s time to get your Christmas shopping started. We all know how hectic Christmas shopping can be, especially… Read more

When to get life insurance

Taking out a life insurance policy is a big decision, and requires a lot of forethought and contemplation before deciding what the best policy for you is. Life insurance isn’t ‘essential’ (like car insurance) and you may not be thinking about it just yet – especially if you don’t have dependants who rely on your… Read more

How to Save Money for Your New Vauxhall Corsa

The fourth generation Vauxhall Corsa is undoubtedly one of the best cars on the market today. It’s Vauxhall’s most popular car in the UK, and is also a model that is used by hundreds of driving instructors, making it a popular choice for first time buyers. If you’ve decided to buy a Vauxhall Corsa, however,… Read more

3 of the Best Gaming Mobiles of 2014

Mobile gaming represents huge business in 2014, and there are a number of factors that have contributed to this trend. In addition to the ongoing sophistication of mobile handsets and their constantly evolving specifications, for example, smartphones and tablets also offer a wireless gateway into a more connected and multi-platform world. These factors all combine… Read more

Desktops vs. Mobile vs. Laptops: Which are better for Gamers?

When it comes to gaming, there are now a multitude of devices on which players can experience their favourite titles. While this level of diversity is seen as a positive development, however, it can be a challenge for players to identify the best possible platform for playing specific games. This has arguably… Read more