It turns out that a personalised license plate isn’t just for the show offs, it can also be for the savvy. A personalised registration can work as a sound investment. As trends ebb and flow so too does the value of a license plate. A simple 1D plate warranted £352,000 when sold in 2009 at… Read more

New year financial boot camp: refinance your mortgage

Are you ready to kick start the new year with a bang? To help you do just that, I have put together a month long financial boot camp, with two tips per week and a call to action. Together, we will review several aspects of your financial life to make sure you start the year… Read more

New year financial boot camp: lower your monthly debt payments

Are you ready to kick start the new year with a bang? To help you do just that, I have put together a month long financial boot camp, with one or two tips per week and a call to action. Together, we will review several aspects of your financial life to make sure you start… Read more

New year financial boot camp: utilities and bill check-up

Happy New Year! I hope you had a lovely holiday season and you are ready to kick start the new year with a bang. To help you do just that, I have put together a month long financial boot camp, with two tips per week and a call to action. Together, we will review several… Read more

How to keep a long term travel budget

I have been in Madrid for about two weeks now, and will spend another 2 1/2 weeks in Europe before going back to Guatemala. Traveling long term is what I like to do, because you don’t have to rush from one hotel to the next, I hate packing, I always forget something in the hotel,… Read more

Alternative Ways to Finance London Student Living Costs

With the always rising cost of tuition and other related costs, it is getting more and more expensive to get a degree. If you are familiar with the archives of Savvy Scot, you know I always strongly recommend to run the numbers before getting into several years of negative cash flow in pursuing advanced education. In general,… Read more

Rent out your spare room and earn some extra cash

Most of us have been renters at some point in our lives. Whether it’s booking holiday accommodation, or long-term renting, we have all been part of the rental market. But renting doesn’t just have to be looked at with the dread of depleting your finances. By renting out your spare bedroom you could instead earn… Read more

Moneystepper’s 2015 Saving Challenge

Fancy a new challenge in 2015? Want to save more money and become wealthier? If you do, Moneystepper.com may have just the thing for you. The Moneystepper 2015 Savings Challenge is a free community where participants in the challenge are working together to accelerate their climb up the steps to financial freedom. So, how does… Read more

Funding retirement debate on new pension rules

In case you haven’t heard, the pension reform will roll in from April 2015, and change quite a bit about the way you can fund and use your pension. On April 2015, people over 55 will be able to access their pensions freely as long as they pay income tax, instead of receiving an annuity…. Read more

Thoughts before buying a new car

A few months back, I went to the border to import a new to me car. It is a cute 2006 Hyundai Tucson with over 140,000 miles. When I bought it at an auction site, only one other bidder seemed to have a small interest in it, most people where bidding on two year old cars… Read more

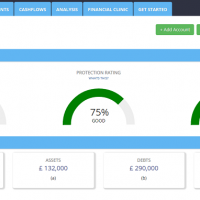

Take control of your finances in the new year with uMoneyBook

Can you believe there are only two weeks left in 2014? I know, me neither. And with the new year, comes the perfect time to take care of your finances! That means cleaning up your financial house, and setting goals for the year to come. And there is a perfect tool to help you do… Read more

Why do people choose secured loans

Loans secured against assets are a popular choice for people who may find it difficult to obtain other types of products or for those who want access to larger amounts of money or longer repayment periods. They usually offer better rates than unsecured loans but do require people to have assets, such as their… Read more