The below article outlines the impact of interest on credit card debt and utilises data from Australia. To learn more about finances check out Low Income Loans Australia, a personal finance site which helps low income earners with non-profit and government initiatives with regard to money matters. According to a recent study, Australians are… Read more

Viewing category: Money

Making Savvy Office Choices

Choosing offices can sometimes be a case of books and their covers. When we see swanky headquarters, we immediately assume that the business too must be equally impressive. Many successful enterprises have exploited this prejudice to their advantage. Unfortunately, this same concept has also convinced many smaller startups to spend unreasonable amounts of… Read more

The hidden costs of a road trip abroad

There’s perhaps no better way to explore a foreign country than by hopping in the car and driving the same roads that the locals do each day. With the freedom of a road trip, you can see out-of-the-way sights and natural attractions that you may not be able to access when restricted to public transport…. Read more

Starting your own online store

One of the biggest barriers people face when opening a business are the starting costs. Thankfully, with advances in technology and payment systems, there are now a low of small businesses you can start with little or even no money. You can create a profile on sites like Elance and get started with promoting… Read more

The People’s Shepherd: How to Improve Your Leadership Skills

To quote John Quincy Adams, if your actions inspire others to dream more, learn more, do more, and become more, you’re a leader. Being a leader may seem intimating and overwhelming, but everyone is capable of leading. Get in touch with your inner leader to bring about the change you wish to see in… Read more

Budget 2014: What It Means For Your Small Business

There was a lot covered when George Osborne recently revealed the budget for the coming year. But what does it all mean for your small business? Let’s take a look at a few of the relevant highlights: Grants For Small Businesses to Take On Apprentices “To make sure we give young people… Read more

Simplicity and convenience for small business owners

Today, as a small business owner, there are tons of little improvements that are here to make your life better, and much, much easier than before. Think about it: now you don’t even have to wear your best suit, or go to the office, you can work from home with an old sweater, and… Read more

Cricketing Success Boosts Stock Markets – IG Reveals

Research from leading CFD and financial spread betting provider IG has revealed that winning an Ashes series bolsters the victorious nation’s stock market, with English wins followed by the biggest average gains. The euphoria around Ashes triumphs is often linked with an upturn in consumer confidence, but the little that is known about its impact on… Read more

The credit cards of the future

What do you imagine when you think about the future of credit cards, or payment methods in general? I remember when flashing a code with your smart phone was considered an odd occurrence you would only see in Japan or South Korea, and yet now it allows you to pay for some products directly with… Read more

How to Know if An Office Space is Perfect for Your Business

Finding an office space is one of the most difficult things to do these days especially when you are very mindful of your budget. There may be a lot of office spaces in Sydney but you have to be discerning as to the place that you will choose as it can have a huge impact… Read more

Top 10 mistakes traders make when filing their taxes

April 15th – the day that makes most of us shudder. Dealing with taxes can be a complicated process for the average person, but investors have an even trickier time staying in compliance with the IRS tax code. While online programs like TurboTax, for example, might be a good fit for someone with straightforward financials, traders… Read more

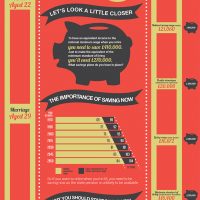

Are you a life saver?

Hi there! Today I wanted to share with you this infographic from AJ Bell Youinvest, as it is a perfect follow up of my lifetime of savings series, where we talk about why you should save and invest money and how to do it specifically in your 20s, 30s, 40s and 50s. I can’t empathize… Read more