Subscribe to SavvyScot Updates – Enter your email address: It seems like only 5 minutes ago that it was Friday… yet it is almost time to go back to work. The weekend has literally flown past. It’s that time of the week again where I review the stats at SavvyScot and mention some great… Read more

5 Top Tips for The Holidays

Taking a holiday is an important life balance. Whether you’re taking a staycation or getting on a plane to the other side of the world having some relaxation and/or adventure away from home is healthy. However, you need to make sure that you are ready for what’s coming. Let’s take a look at five top… Read more

Change Your Life Series – Step 3 Knowledge

For those of you who are new to the ‘Change Your Life Series’ then fear not – there is still time to make a huge difference. Here’s what you have missed out on: Part 1 – Exercise Part 2 – Eating Healthily Part 3 – Get Smart & Learn You will be pleased to hear… Read more

The New Gender Directive and Your Pension

The world of annuities has been turned upside down of late thanks to a directive from the European Union. The directive in question relates to the current disparity in the rates quoted for annuities paid out to men and women which has stood for a number of years. As a result, from December 2012, the… Read more

How to Cut the Cost of Clothes

The following is a guest post from an up-and-coming blogger. Contact me if you are interested in guest posting at SavvyScot. Cutting the Cost: (from a male perspective) We all have quite a different attitude to clothes and clothes shopping. Some people insist on every item in their wardrobe being freshly updated on a routine… Read more

10 Tax Tips for Contractors & Freelancers

Today I am pleased to introduce a guest post which is probably very relevant for a lot of SavvyScot readers. While we have all no-doubt heard various scandals on tax returns in the press, Danbro have some fantastic legitimate tips to share! While tax returns is not something I like to think about very often,… Read more

The Saver: Which Category Do You Belong To? … And a Giveaway

Saving Money is Hard Why is saving money so much harder than spending money? Spending money comes so easy… some might actually say that spending money gives them huge amounts of (temporary) pleasure! Why do we not get the same level of enjoyment out of paying £100 into a savings account that we do blowing… Read more

The Sunday Review – Top Posts of the Week

Subscribe to SavvyScot Updates – Enter your email address: It’s that time of the week again where I review various statistics at SavvyScot for the week and give a big shout out to my fellow bloggers whose posts I have particularly enjoyed this week! The weekend may almost be over, but there is still… Read more

The Friday Feeling

Happy weekend everyone (or nearly for my readers on the other side of the pond). Today you don’t have to read anything.. instead you get to put your email address in the box below and press subscribe. Instead of writing a little blurb at the top of a post about it… I have dedicated… Read more

Money Saving Apps

If you have a smartphone or a tablet device then you will have probably investigated the app marketplace that it offers, perhaps installing one or two games and a photo-editing program. However, there are plenty of apps available that are explicitly designed to help you save money on a daily basis. Here are just a… Read more

Change Your Life Series – Step 2 Eat Healthily

Have you joined the cool kids as a subscriber of SavvyScot.com yet? ——–> Last week we started the Change Your Life Series; a series of ten blog posts that (if followed) will change your life – guaranteed! The first post was centered around Exercise. For the last seven days you have been slowly increasing… Read more

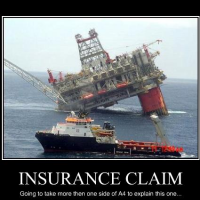

Can you trust a sole trader without professional indemnity insurance?

A sole trader, also known as a sole proprietor, is a reference to the self-employed owner of a business. They are personally responsible for all profits, losses and the day-to-day running of the business, including all forms of paperwork such as insurance. One form of insurance that sole-traders should purchase is indemnity insurance. This is… Read more