There has been a lot of talk in the press about an expanding segment of the UK being part of Generation Rent. Up until now little has been said about how to deal with being stuck in the rental market for the foreseeable future. Thankfully Propertywide have produced an infographic that gives advice on how… Read more

Viewing category: Personal Finance

Making the Most of Your ISA Allowances

As the end of the tax year is only days away, now is the time that UK residents should be thinking about their ISA allowances. The 2012/2013 allowance for adults is £11,280 – up to half of which can be put into a cash ISA. I have previously discussed investment ISAs in greater depth, but… Read more

Is the UK Catching-Up with America on Law Suits for Medical Negligence?

For as long as I can remember, the US have loved a law suit. Whether it be slipping at work on a newly cleaned floor, or being offered incorrect advice from a ‘professional’; lawyers certainly have a lot of potential business. In comparison, UK courts have been relatively inactive; it has always been rather uncommon… Read more

The A-Z of Saving Money Book

Afternoon all! I write to you in an extremely fragile state after just making it back from a weekend away in Riga! Being the slightly tight (and very sensible) people that we are, we chose the most horrendous budget airline – Ryanair. For those of you who have never heard of them, they are masters… Read more

How to Pay Less for Broadband

In line with my recent posts about cutting your basic spending, today I am hosting a post that fits in nicely with this strategy to reduce costs! Enjoy folks.. Given that you’re reading this blog online, it’s fair to assume that you’re paying for broadband. Unfortunately, the likelihood is you’re paying too much. In… Read more

What’s On Your House Hunting Checklist?

A couple of weeks back I wrote a post discussing the tactics for first time buyers. I discussed a number of considerations that you should make before and during your first house purchase. While I briefly touched on ‘Finding the Right Property‘ after some of the comments I felt that I didn’t emphasise the importance… Read more

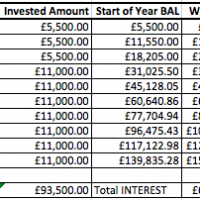

You are Never too Young to Think About Pensions

One of the main selling points about my employer is that they offer a defined benefit (final salary) pension. This essentially means that each month I pay into my pension fund which is a proportion of my final salary. For each year that I work, I gain around 1.9% – a 30 year career would… Read more

Tactics for First-Time Buyers

It was less than a year ago that Mrs Scot and I first jumped on the property ladder. While many finance bloggers preach that renting a house is far superior to buying – After 11 months of home-ownership I can honestly say that it was the best decision ever! While technically speaking, we don’t fully… Read more

How I Live Within My Means

Going to go off on a little bit of a tangent before we get into this post… Long term readers of this blog will know that I have a long commute to and from work. Between the two of us, we travel almost 140 miles every day. Not only is this costly from a fuel… Read more

The Importance of Budgeting in Financial New Year Resolutions

Have you kept your New Year’s resolution? According to 2011 research by allabouthealth.org.uk, the majority of British people give up just nine days into January! If you resolved to sort your finances out in the New Year, but you’ve already started going off-course, you might be wondering what you can do. Having your resolution fail… Read more

Passive Income Series – Method 2: Income from Investing

You might have noticed that it’s been pretty quiet around SavvyScot over the last week or so. As I mentioned a few weeks back, I have been co-writing a book with a bunch of great financial bloggers and yesterday was the deadline! All my writing time has been dedicated to finishing the two chapters that… Read more

3 Things to Consider Before Jumping on the Property Ladder

Housing: Something we all need, yet many can’t afford. Property is an area of investment that it is a little different to stocks and shares. No matter how the economy performs – regardless whether we are in a recession or not – housing will always be required. From an investors point of view, this is… Read more