As the end of the tax year is only days away, now is the time that UK residents should be thinking about their ISA allowances. The 2012/2013 allowance for adults is £11,280 – up to half of which can be put into a cash ISA. I have previously discussed investment ISAs in greater depth, but today want to emphasise the importance of not waiting until next year.

Why Tomorrow is Too Late

The unique thing with an ISA is that the allowance is the same for every adult in the UK. It doesn’t matter if you are absolutely loaded and take home seven figures a year – or you are on minimum wage; everyone has the same limit. What this means is that although you might have more money in the future to invest, you will never recover the tax benefits of missed investments. Your allowance is not transferable, nor does it accumulate.

Sounds like common sense – right? Well perhaps it is more powerful to take a look at some examples of actual figures which highlights the power of compound interest!

Example 1 – The Dedicated Saver / Investor

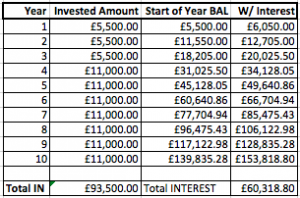

Let’s assume that you start saving at the age of 20. Furthermore, let’s imagine that for the first few years you can’t afford to max out the ISA, but you contribute half (funded through working summer jobs at college) and then max it out after you graduate (you love the way that the interest/growth is accumulating so much that you are excited to max it out). Assuming a return of around 10% p.a. (which is definitely possible with an investment ISA) consider the following figures:

Not bad right?

Example 2 – The ‘I Will Invest When I Have More Money’ Saver

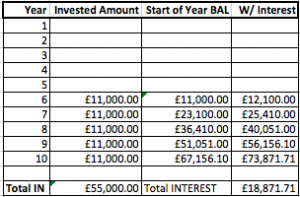

Let’s assume this saver doesn’t feel that there is much point investing at this stage. This saver might think that ISAs are something that fit in the same category as pensions – something that is not important until later in life. Let’s assume that this saver waits until they are 26 and have enough money to fully fund the ISA. Assuming the same return of 10%, the figures would look a little different:

While you might think that approximately £19K of interest is not too bad, we must compare the situation to the dedicated saver’s. The dedicated saver invested £38,500 more over the course of the 5 years where this saver was waiting. This accounted for over £40,000 more interest than this saver over the period of the investment. The bottom line is that compound interest works slowly over time; slowly building up to become a big beast!

And Then it Gets Really Interesting!

The thing that seals the deal for me is when you look at future years. If we look at year 11 for both savers, The second saver will earn interest of about £8,500 whereas the first saver will make a whopping £16,500!! It doesn’t matter how rich each of the savers get, they will only ever be allowed to invest that year’s allowance and the head start the first saver gained (through 5 years of saving) as set them leaps and bounds ahead.

If you still need convincing, let’s consider what happens 40 years in (when the savers are both around 60 years old:

Saver 1’s Annual Interest – £300K

Saver 2’s Annual Interest – £425K

The difference is completely crazy!!! No matter how hard you try to recover from the missed opportunity of Tax Free Investing – you can’t!!!

ISA investing is very different to saving for a mortgage. When buying a house, there is no limit to how much you can put towards your deposit – it sometimes makes sense to wait until you can get a more competitive rate. Your savings accumulate and the deal makes sense. When saving in an ISA, there is no point in waiting until next year if you can afford to invest now! Take full advantage of your allowance, your partners allowance and your children’s allowance (child ISAs). You will never recuperate the lost opportunity.

My Plan

As I write this I am currently planning the final stocks to add to our Investment ISAs for this year. Collectively we have over £22,000 of allowance to invest, which I might add that we have not maxed out this year. In years to come, I will continue to invest in our Investment ISAs, Fixed Rate Bonds and Cash savings. The one day – in the not so distant future – we will cash many of these in to follow our dream and buy a dive center. As the old saying goes – You can’t take it with you!

Have YOU maxed out your ISA this year? If not, why not?

You’re right; compounding really outputs incredible results. Great post.