If you have a brick-and-mortar business and are conducting business in a particular state, you have to register your business there. That means that the business has to file reports and pay taxes regardless of whether it was originally formed in that state or not. Generally, it makes no sense to form your corporation in… Read more

Think you know what your car’s worth? Don’t get a nasty shock…

Most of us worry about how much our car is costing us; fuel, insurance, tyres, servicing costs all mount up (and that’s without any unwelcome surprise repairs). This blog has written before about how driving at 50mph can cut your fuel consumption, and research earlier this year showed many of us have made a conscious… Read more

5 Surprising Ways of Saving Energy at Home

Close the windows in winter; switch off appliances that aren’t in use; invest in loft insulation. The classic mantras of saving energy at home are repeated ad nauseam by governments and the media. However there are also a number of lesser known tricks that can actually go a long way in reducing your annual energy… Read more

Listen, React and Communicate to the Audience

Your website is your shop window to the world. It is essential that the world likes what it sees. Time spent in producing interesting text is never wasted but it is important that your website become visible to an increasing number of visitors. That is your potential audience that must be engaged and retained at… Read more

Money Saving Tips for Motorbike Insurance

A few years ago upon graduating, I decided to do my motorbike test. Riding a bike is always something I spent summers in Thailand doing (unofficially) and I wanted to make it all legit and ride something fast. An intensive course and an impulse buy later, I was the proud owner of a Yamaha R1… Read more

I’m Going to Save Myself a Fortune!

There is something pretty dull about discussing mortgages isn’t there? It is for this very reason, that so many people sign up for a mortgage one time and never bother to change it unless they move house! A very good friend of mine made himself a small fortune in the markets crash of 2008/2009. Tracker… Read more

An Age Old Saying: Take Care of the Pennies

…. and the pounds will take care of themselves! How many times have you heard this phrase? Growing up, my mum would always remind me and my siblings that if you make sure and look after your change, it all adds up to buy a bigger thing in time. Unlike my friends, I was never… Read more

Are Daily Discount / Deal Sites still Worthwhile?

Daily deal sites have been around for a number of years now. The advertiser offers a huge discount – sometimes in excess of 50% – in an attempt to market a product or service and get you to come back for more. In effect, they are often not making any money (in some cases maybe… Read more

Young Workers Shouldn’t Delay on Buying Income Protection

Young workers may be interested to read a recent study* which shows just how important income protection insurance is – and how the earlier in their working life they buy it, the more savings they are likely to make on the overall cost of the cover. What is income protection insurance? Firstly, this is nothing… Read more

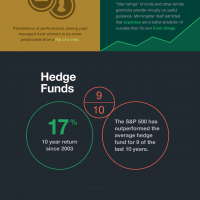

Managed Funds or Index Funds? INFOGRAPHIC

Long term readers of Savvyscot will know that I like to invest. In fact, all money that I have made from this blog to date has gone directly into the stock markets, in one form or another. When I first start out investing, I had to consider how I was going to do this. Given… Read more

A NEAR financial disaster

A couple of weeks back a good friend of mine came to stay on his way to moving abroad. I planned my work week around his visit to ensure that I could work from home to maximize the time spent together and that most of my late night meetings were scheduled before and after he… Read more

Do annuities make sense for retirement provision?

It’s something millions of us are encouraged to do as soon as possible, but can saving for retirement really make a difference? In short, the answer is yes. Even setting aside a seemingly negligible amount of out monthly or weekly pay packet of, say, £5 or £10 a time can add up over time. Saving… Read more