Auto insurance is a necessity that virtually every car owner has to have by law. Many states go a step further and require a minimum amount of coverage on every automobile that’s rolling down the road. But the cost of that coverage largely depends on how your plan is set up and the vehicle you… Read more

Lifestyle Changes: When Fun Turns into Addiction

It started out innocently enough: you met your friends for a drink after work in the neighborhood pub whose food you all really like. A fantastic time was had by all, so you made plans to meet up again in a few days. Then you started going there regularly for trivia night and then for… Read more

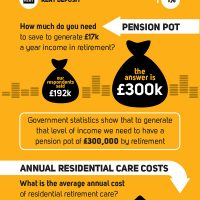

Are we underestimating the cost of retirement?

Research from 247Moneybox.com shows that Brits aren’t too worried about retirement, and many underestimate both the costs of residential care, and how much they should have in their pension pot in order to live well in retirement. Respondents underestimated the pension pot size required to generate £17,000 a year income by £108,000 46% of… Read more

Make saving effortless with Plum

I have talked a lot around here about willpower. We have a limited amount of it, and that is why many successful entrepreneurs try to remove trivial decision making from their busy lives, so they can focus on what is really important. Yes, that’s why Steve Jobs wore the same outfit every day. No… Read more

10 Reasons Why You’re Still Broke

Happy Monday everyone! This is a guest post from my V.A. Clarisse. Let me know if you would like to guest post on SS. Ever wondered why you’re still broke, even though you have a job and a salary? Keep reading! You don’t have savings. You have a bank account, but it’s always empty! It… Read more

New Home Designs: Complete Renovations before Moving In

Moving can be pretty chaotic no matter what your situation is. It is important to take the time to figure out a plan that works for you and your family to make your move successful. Before you transition into your new home, it makes sense to complete certain renovations ahead of time to make… Read more

National insurance income tax – National Insurance (NI) was historically a way of paying pensions and other benefits but is really just another form of income tax.

This is a guest post from David over at Dodgy Statistics. Please let me know if you would like to guest post on SS. Hello! Over at my blog, I have talked about the referendum campaigns (who are trying to push you into a decision) and corporations (who are trying to sell you stuff). For this… Read more

How to make the most of your inventory

If your excess inventory is choking your cash flow, it’s time to look seriously at inventory management procedures and practices, such as purchasing barcoding equipment and taking your inventory live. It might seem like a big step, but it’s actually a series of small steps that will get you where you want to go. Basic… Read more

Over a third of people aged 45-54 believe registering to vote will improve their credit score

A new study, conducted on behalf of leading prepaid current account provider icount shows that the older generation of Brits are more savvy when it comes to taking action to improve their credit rating, with over a third of 45-54 year-olds believing that registering to vote will improve their credit score. What does this generation… Read more

Do You Find Motor Insurance Too Complex?

If you find motor insurance too complex to understand, you are not alone. About half of motorists (48%) find motor insurance confusing, according to a recent Co-op study. UK drivers said they were mostly confused about how premium is calculated (51%), why prices change annually (43%), what isn’t covered (39%), and what is covered (28%)!… Read more

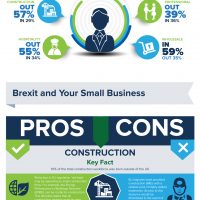

A Brexit Guide For Small Businesses

Have you made up your mind about the Brexit vote already? There is little time left! If you are a small business owner and still unsure about how to cast your vote, check out this infographic that takes a look at whether Britain should take the plunge and ‘Brexit’, or remain in the EU. The… Read more

10 Things to Know Before You Take Out a Cash ISA

With the UK economy finally getting back on its feet after the economic slump that plagued most of the last decade, it’s time to start making your money work for you. According to data supplied by HMRC, as many as 16 million Britons already had a cash ISA back in 2014. To join that increasing… Read more