Are you familiar with the new ISAs? They launched back in July 2014, and just like the “old” Individual Savings Account, they allow you to save money tax free, in the form or cash, or stocks and shares. The big changes of the New ISAs were a huge increase in the yearly allowance, to £15,000 per person, and the fact that you can now choose to save it all in stocks and shares, or all in cash.

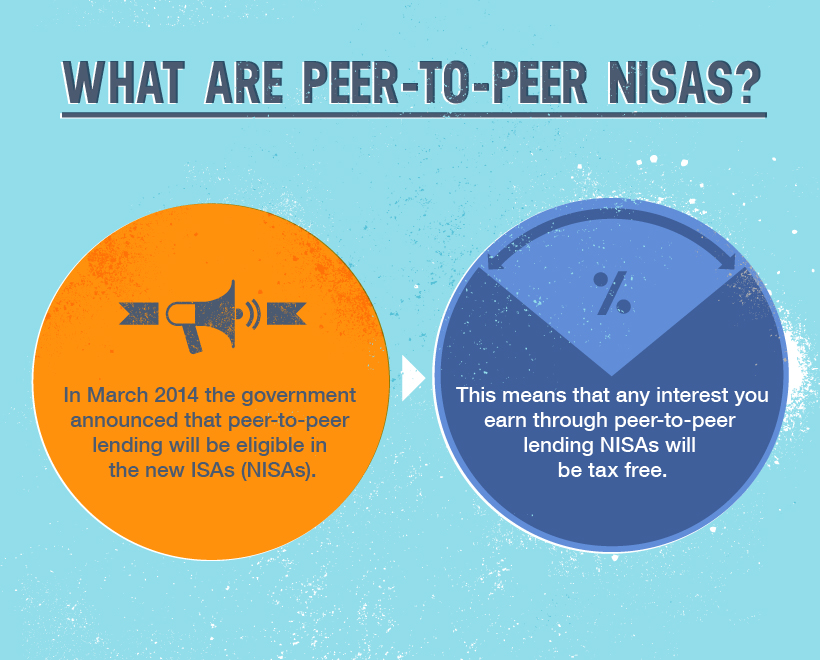

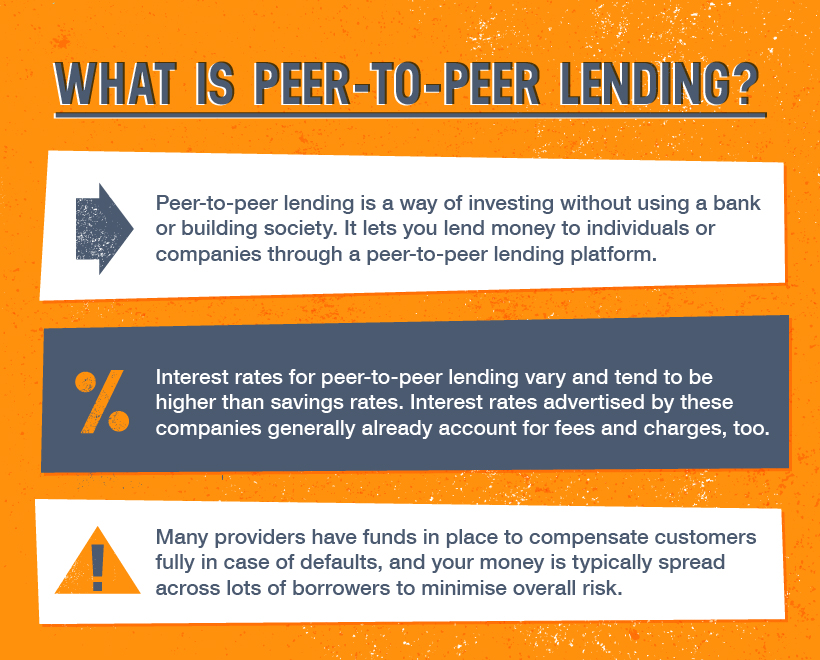

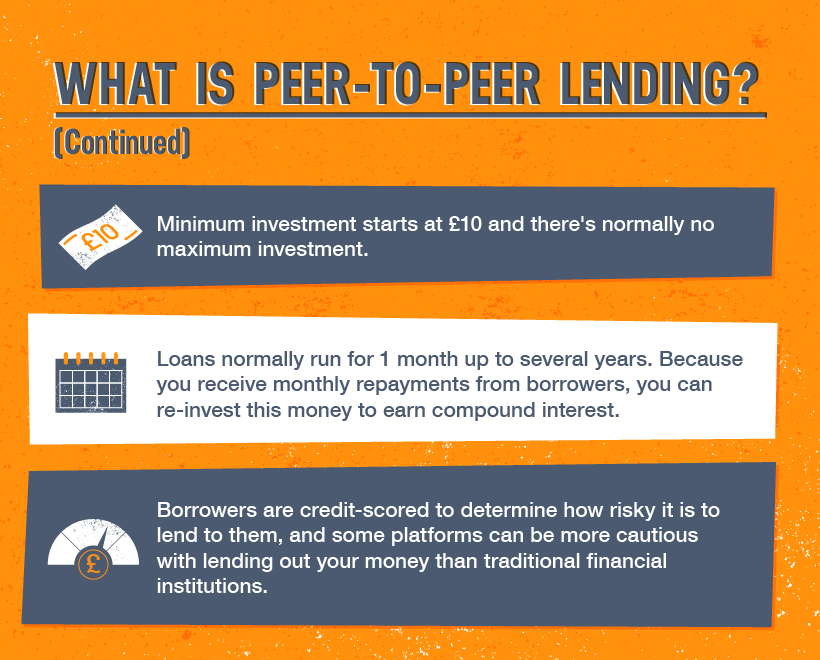

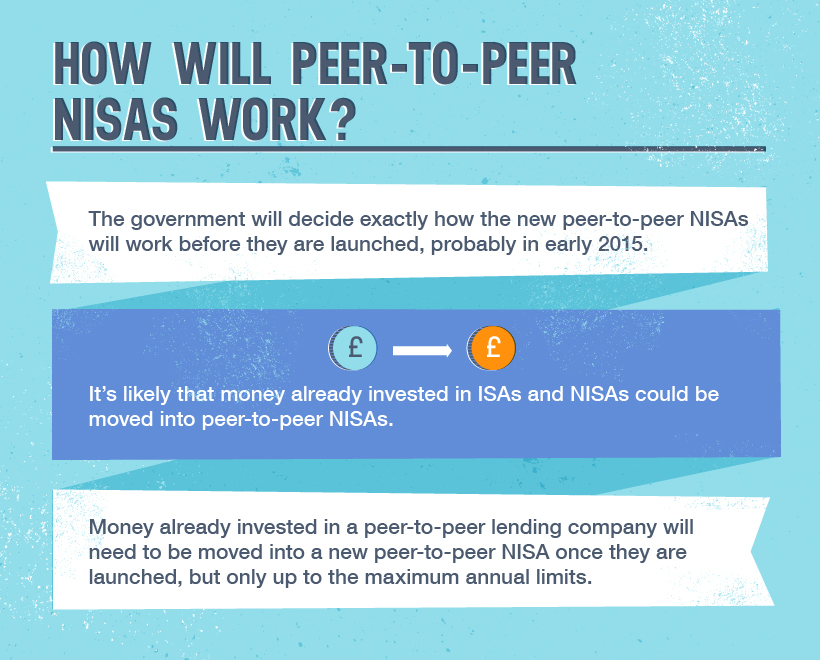

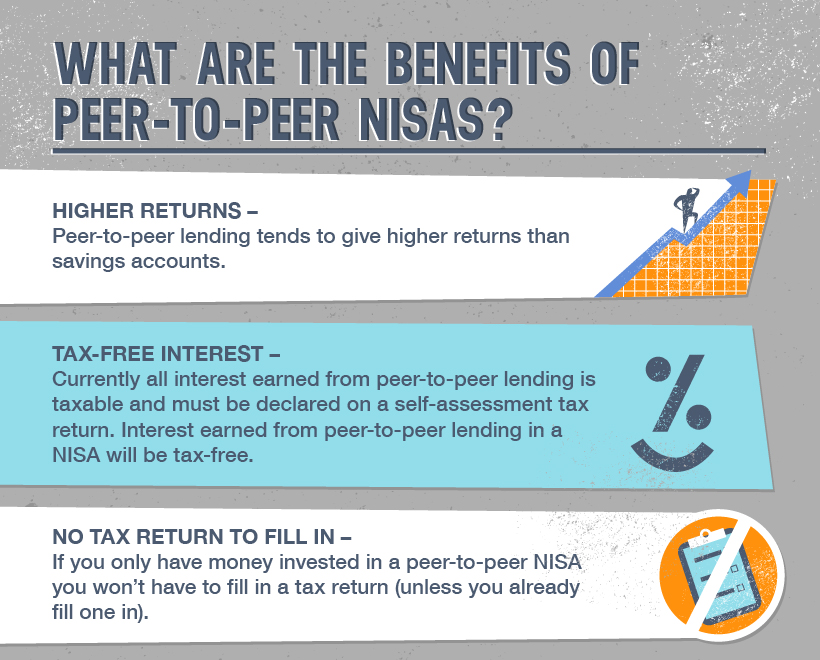

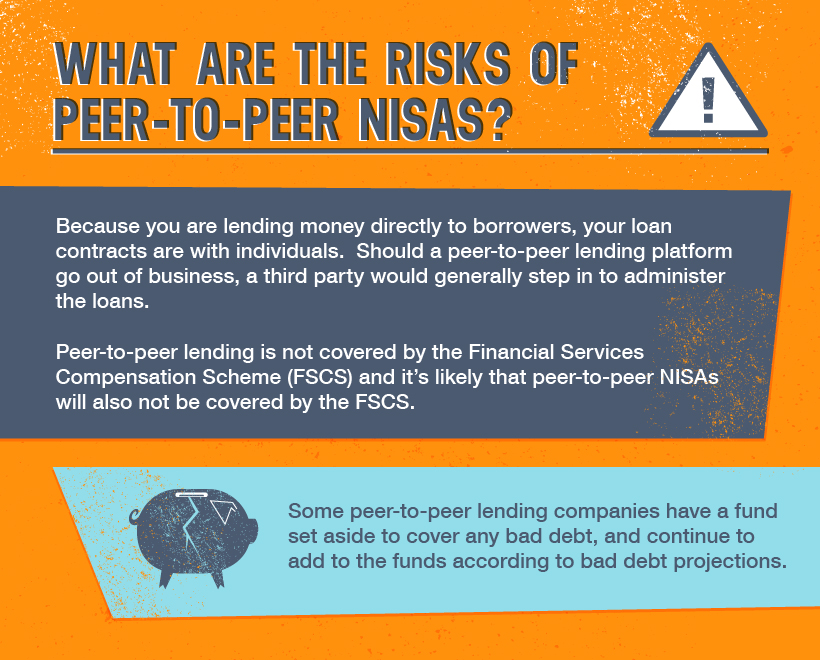

Another new feature that was announced with the NISAs is that you could add the money you are lending through peer-to-peer companies, such as Zopa, under the tax-free scope of the ISA. Details are still being discussed and peer-to-peer NISAs will probably launch at the beginning of 2015, allowing people who are already into peer-to-peer lending to get a tax exemption on their loans. As a saver, it could be a way to diversify your portfolio as well, although it comes with more risks than the regular savings account as you will see below.

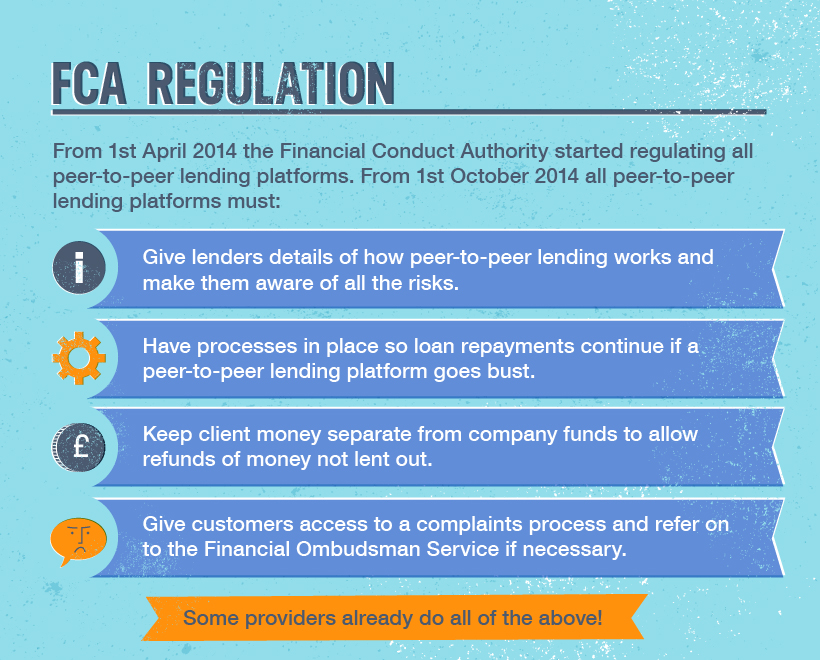

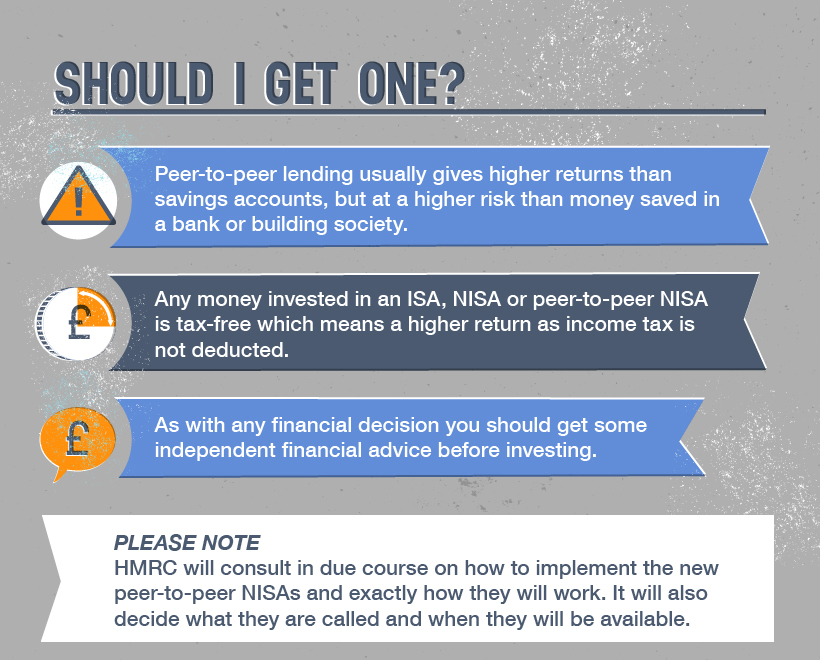

If you would like to learn more about peer to peer New ISAs (NISA), Zopa has put together this infographic for you, enjoy!