Happy Saturday one and all! As regular readers will know, I spent the last week in Moscow which is why there has been a complete lack of posts this week! I should have been a lot more organised, but given I spent last weekend partying in Latvia, my writing day on Monday was instead spent nursing a hangover from hell!

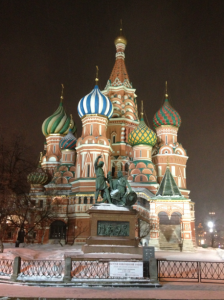

Anyway, I am back in the UK and spent the last week staying in the most luxurious hotel I have ever seen. Between business class flights and VIP pick-up services, I have spent the week living like a celebrity. What is better news is that I have a heap of great photographs to share and a couple of posts coming your way next week! Here is a teaser for now..

Steve @ Grocery Alerts writes 10 ways to save more money at Costco – Costco provides great regular warehouse savings, but here are 10 additional ways where you can save more money having a Costco membership.

Emily @ Evolving Personal Finance writes Hard and Soft Earmarks in Targeted Savings – Some of our short-term savings accounts are non-negotiably reserved for certain purposes, but others are more flexible.

Mike @ The Financial Blogger writes The Storm is Over – What happens when the storm is over.

Div Guy @ The Dividend Guy Blog writes How Spending Cuts Will Hit Your Portfolio – Will spending cuts impact you?

Lance @ Money Life and More writes Moving Soon? How and Where to Get Free Boxes to Save Money – In addition to learning how to move I’ve also learned how to save money while moving. One of the biggest costs can be packing materials (moving boxes, wrapping paper, bubble wrap, etc.) and I’m going to share with you how I managed to get these items for free!

Robert @ Entrepreneurship Life writes Will Your Small Business Succeed or Fail? – Entrepreneurship is a high risk and volitile endeavor. The infographic below explains that only 35% of small businesses are still around in 10 years.

Jeff Rose @ Good Financial Cents writes Penny Stock Debacle: How I Lost $5,000 and You Can (and Better!) Avoid It – When buying an over-the-counter stock, otherwise known as a penny stock, you must be sure to protect yourself and make sure that when you place an order to buy or sell, that you put a specific price on it. Learn from my mistake!

Jennifer Lynn @ Broke-Ass Mommy writes Hecka’ cool! It’s the official launch of our financial eBook, The A-Z of Saving Money – Check out the A-Z of saving money! My first ebook.

CAPI @ Creating a Passive Income writes Tools of a Passive Investor – Passive income is all the hype these days. Many of my closest friends are finally understanding the power of passive income. As we all know, it takes time and money to generate passive income. It’s not as easy as some may make it sound, but it is a great way to build wealth. Focusing on passive income also means that you are focusing on the time investment.

Luke @ Learn Bonds writes 4 Convertible Bond Funds for Investors to Explore – A list of convertible bond funds for those those interested in adding portfolio exposure to convertible bonds to their portfolio.

BARBARA FRIEDBERG @ Barbara Friedberg Personal Finance writes How to Talk About Money with the Family-The M Word – Deal with family money issues. Learn how in the M Word.

Maria @ The Money Principle writes About net worth, value and structure – Knowing how much is your net worth is helpful but could be misleading. Another important aspect of wealth to consider is its structure.

krantcents @ KrantCents writes I Am Broke! – I am broke, but not broken! Do I have your attention? Should you feel sorry for me? Do I need help? Perhaps, I need a psychological evaluation? My answer is simple, don’t worry about me! You can take away my credit cards,

Crystal @ Budgeting in the Fun Stuff writes Ask for Discounts or Get Screwed… – I don’t know how else to say this, I took 15 minutes and saved 15% or more on my car insurance. Call and ask for discounts or you could be vastly overpaying!

Roger the Amateur Financier @ The Amateur Financier writes My Bucket List (So Far…) – I’ve been thinking a great deal lately about bucket lists, that is, lists of things that people want to do before they die.

Jessica @ Budget for Health writes Everyone has a plan until they get punched in the face – Mike Tyson probably wasn’t referring to financial planning, but boy does it relate!

Jon the Saver @ Free Money Wisdom writes Five Red Flags that Could Trigger an Audit – Here are five red flags that can easily trigger an audit with the IRS. You will want to avoid these this tax season!

Suba @ Broke Professionals writes My Best Meeting Tips – You probably have attended business meetings, or family meetings, or public meetings and may have considered most of them a waste of your valuable time.

SFB @ Simple Finance Blog writes Annuities: What Every Investor Should Know – Here is a simplified overview of annuities. We will look at three basic types of annuities that are the foundation of the concept.

harry campbell @ Your PF Pro writes Does it Make Financial Sense to Move In With Your Boyfriend or Girlfriend? – Whether it’s after a few months or a few years, after a certain point in every relationship you’ll probably consider moving in together. It’s a natural progression in most couples’ relationship and at this point, you’ll have to weigh the positives and negatives. You will save on gas driving to each other’s houses, save on food cooking together, save on utilities, etc. Financially, it sounds like a great move but is it the best thing for your relationship?

Tim @ Faith and Finance writes Can You Be Too Frugal? – This can seem like a ridiculous question when you are struggling to pay your bills, pay off debt, or to save money. But it’s also an important question because there’s a difference between being frugal – and being cheap!

Daniel @ Sweating the Big Stuff writes 3 Things We Pay For That Prove We’ve Become Lazy Americans – We pay for things we don’t really need out of laziness. Watch out for these 3 budget busters!

Michelle @ The Shop My Closet Project writes How to connect with new people without being a creeper – Last week I went to Atlanta to attend a conference. While I was there I wanted to connect with a friend of mine from Up With People and with some personal finance bloggers who live in Atlanta. I had never met them before and quite honestly they are pretty well known in the personal finance community and I am not. I’m a big believer in meeting new people but introducing yourself to new people can be tricky. You don’t want to come across as a creeper.

Crystal @ Married (with Debt) writes Starting Your Nest Egg: Investing In Your Marriage – Why not start your marriage right with an investing nest egg.

Buck Inspire @ Buck Inspire writes Stop Your Services Mr. Telephone Man! – When moving to a new home, you of course need to setup utilities in your new place. But do you always remember to shut everything off in the old? Don’t pay for services you won’t be using anymore!

Kanwal @ Simply Investing writes What is Total Yield? – High dividend yields combined with stock buybacks give you -Total Yield- a term coined by Chris Brightman of Research Affiliates. Shawn Tully from Fortune has recently written a great article on Total Yields which appears in print.

SBB @ Simple Budget Blog writes Your Next Days Off: Budgeting for Vacations – Got some vacation days to spend? For a successful and fun time off, stress-free, use these steps on budgeting for vacations.

Tony @ We Only Do This Once writes Be Willing to Look Stupid – The only way we improve at something is to push the boundaries of the possible. We need to build new connections in our brain; which means screwing up after reaching for a new skill…and often looking stupid in the process.

Sam @ Simplefinancialfreedom writes How to Avoid a Tax Audit – Preparing and filing for your taxes is far from an easy exercise.

JP @ My Family Finances writes Kid Friendly Healthy Eating Tips – The key to this is to find a method that woks for your entire family, this includes your youngest child, all the way to grandma.

Debt Guru @ Debt Free Blog writes Hidden Fees When Traveling – My wife and I started planning our annual vacation last week. Every year we plan a week-long vacation to celebrate our anniversary. We usually alternate having a “big” vacation and a mediocre vacation. These are poor descriptions, but the basic idea is one year we take a more expensive vacation and the next, a moderately-expensive one.

Lauren @ L Bee and the Money Tree writes How to Ruin a Friendship In 3 Easy Steps – Want to know how to ruin a friendship? Involve money.

Ted Jenkin @ Your Smart Money Moves writes Out Of Financial Shape? Try CrossFit – Over the past several years, CrossFit has taken the nation by storm as one the newest and fasting growing fitness crazes.

MMD @ My Money Design writes Wealth Creation Strategies That Are Within Your Reach – With the information age and all the resources that come with it, there are more wealth creation strategies and opportunities available to us than ever.

Amanda L Grossman @ Frugal Confessions writes Impermanent Solutions to Make your Apartment More Energy Efficient – Owning a home yields many opportunities to increase overall energy efficiency.

Brent @ PersonalFinance-Tips writes What to do after Bankruptcy – Bankruptcy is one of the most significant events in life, comparable with marriage or divorce in its impact. However, unlike those two events bankruptcy is almost always a sign of bad times.

MR @ Money Reasons writes Roth IRA Unusual Benefits – The following is how I view a Roth IRA, my view is personal and I don’t recommend this approach, since a Roth IRA is a retirement instrument. That said, it works for me!

Kyle @ The Penny Hoarder writes Make Money by Helping College Students – Do you live near a university or community college? Do you know any current college students? If so, you have an opportunity to make money by helping these students! With a bit of creativity, networking and flexibility to work with varied schedules, you can make money by helping college students through the following avenues…

Corey @ 20s Finances writes Ways to Make Extra Money – Everyone wishes that they had a little extra money. It’s time to stop your complaining and use these tips to make a little extra.

Gary @ Gajizmo writes Ways To Save Money – Saving money isn’t easy. There is really only so much you can cut from your budget, but knowing how to save money and finding creative ways to meet your financial goals can make all the difference between a fully-funded retirement and living on just social security and government subsidies. Here are some in-depth methods of reviewing your spending and finding savings, including everyday tips that will transform your lifestyle and develop healthier habits.

Mike @ Personal Finance Journey writes Is There Such Thing as Saving Money While Shopping? – Ever considered saving money when shopping? Did you know its even possible to spend AND save? Easy smart shopping tips that work.

Thomas @ Journey Scout writes Travel the world on a Budget – A little bit of financial acumen can go a long way in earning your trip around the world, here’s how

Jon Haver @ Pay My Student Loans writes 5 Majors With The Highest ROI – Majoring in whatever you love to do will almost always gain you the highest return of interest emotionally. Fiscally, however, it may be a different story. OnlineDegrees.org compiled data using the US Bureau of Labor Statistics.

Evan @ My Journey to Millions writes Updating, Upgrading and Increasing My Life Insurance – In preparation for this post I went through my archive and I couldn’t believe that despite posting about various life insurance topics like when life insurance is taxable, purchasing life insurance on my baby, and even comparing an actual whole life insurance policy, I never provided what I actually owned on my life.

Lazy Man @ Lazy Man and Money writes Now We Can’t Trust the FTC to Protect Consumers? – CNBC has a very good 20 minute investigation on the whole “Is HerbaLife a Pyramid Scheme” question. What I found most interesting is the interview with the David Vladeck who was until recently the Director of the Bureau of Consumer Protection of the FTC.

Wayne @ VisualFin writes How Should You Spend Your Tax Return – People get very excited about receiving a refund and while it may be tempting to blow this unexpected lump sum, you need to know how it should be spent by taking a look at today’s financial infographic on how you should spend your tax refund.

CT @ Cashtastrophe writes The Definition of a Recessionista – Many people have found themselves making financial cuts that they never would have considered before. Frugality is IN! There’s a term being thrown around these days, and that’s recessionista.

Jason @ Live Real Now writes Slumlord Update – Our new rental property leaves $946.75 in profit for us each month. Yay! But wait.

Ashley @ Money Talks Coaching writes My Dad Has Cancer But Not Health Insurance – My dad has cancer. He started chemo today. The onset was fast and severe.

Don @ MoneySmartGuides writes Financial Lessons Learned From The Bachelor – I watch The Bachelor. Every Monday night, my girlfriend duct tapes me to the couch and uses toothpicks to pry my eyes open to watch this season as Sean tries to find true love from 25 women contestants.

Invest It Wisely @ Invest It Wisely writes What Does ‘Early Retirement’ Mean to You? – We often use the same word to mean different concepts, and early retirement means different things to different people.

Jacob @ AllPersonalFinance writes Should I invest in the Forex – The word forex is made up using two words: Foreign exchange. Forex trading refers to any trading in which one buys or sells one international currency against another. Every day, more than $4 trillion worth of forex trading is done all over the world, which should tell us that this is a huge market.

Steven @ MyDividendStocks writes Why would a Company not pay Stock Dividends – Dividends are an important part of the equation when you want to assess a company as an investment. Dividends that are paid out at regular intervals are a sure sign of the good health of a company. Therefore, companies pay out dividend not just to share their profits with their shareholders, but also to signal that their finances are in good health.

Little House @ Little House in the Valley writes Bad Choices Can Be Costly – Many of my poor choices occurred when I was young and I had time to repair them. That’s not the case for an old friend. He knowingly made one terrible choice many years ago and has been paying for it ever since.

IMB @ Investing Money writes Investment Strategies – Everyone is looking for a great investment. Everyone dreams of high rate of returns and liquidity in their investments accompanied by low maintenance. It’s not everyday that you find all three in one. In fact, it’s almost impossible.

Wayne @ Young Family Finance writes The Important Facts About Home Equity Loans – Buying a home is a financial investment can lead to extra money in a few years in the form of a home equity loan.

Matt @ Living in Financial Excellence writes Strategic Planning for the Everyday Family – We started working on our strategic financial plan. We recognized that this should include more than just a few financial goals and targets. We wanted to take some time and plan our family’s future. Financial planning is just a small piece of the overall picture.

Everything Finance @ Everything Finance Blog writes Book Review: I’m on My Own, and So Are You by Judy Resnick – There are many personal finance books out there that cater to both men and women, but there are few and far between that focus solely on women. Financial planner and stock broker Judy Resnick’s new book does just this.

Hank @ Money Q&A writes Easy Ways To Save Money Right Now Without Even Thinking – Stopping yourself from spending money and wasting money is the easiest easy ways to save money right now without even having to think about doing it.

Miss T. @ Prairie Eco Thrifter writes The Easiest Ways to Save Money on Household Expenses – I can tell you a number of ways to save money on household expenses. You just need to put them in practice.

Kevin @ Passiveincometoretire writes 4% Retirement Rule, Pros and Cons – The 4% retirement rule refers to a particular strategy that is used by retirees when they want to use their savings. The rule says that the best strategy when using your retirement savings is to withdraw about 4% of the savings every year, adjusting the sum for inflation every year.

Girl Meets Debt @ Girl Meets Debt writes Eating Single in the City – I should probably start this post with a simple fact. This Girl does not know how to cook. I can not even toast my bread properly without burning it!

A Blinkin @ Funancials writes Should You Buy Stocks NOW? – When people get too pessimistic, I enjoy dishing out encouraging words to breathe life back into their lungs. On the other hand, when people become overly optimistic, I unfortunately have to be the one to bring them back down to Earth. On August 30th of last year, I wrote that Stocks Will Rise and The World Won’t End.

Ray @ Squirrelers writes Financial Spring Cleaning: 5 Tips – With the spring season here, it’s a good time to do a “spring cleaning” of our finances! This post discusses how we can do just that.

Kevin @ 20smoney.com writes Student Loan Forgiveness – Student loans allow millions of students in the United States to pursue an education they otherwise would have missed out on.

LaTisha @ Young Finances writes The Importance of an Ecommerce Business Plan – Creating an eCommerce business plan is an important step for the success of your business. You need a basic understanding of website building techniques.

Tushar @ Start Investing Money writes Should You Look Into Unusual Investments? – When you think about investments you probably think of stocks, shares, mutual funds and various other investments of a similar ilk. However you have more options than this, including some rather unusual investment opportunities you may wish to consider.

Jester @ The Ultimate Juggle writes The Grablet Review – This is a review of the Grablet, an inexpensive accessory for an iPad. It has made my tablet experience that much more enjoyable!

Lynn @ Wallet Blog writes http://www.walletblog.com/2013/03/getting-paid-as-a-caregiver-without-jeopardizing-medicaid-eligibility/ – The most recent figures show that 48.9 million people in the U.S. have served as adult caregivers, with 86% of them providing for a relative in need. Not only do these people have to contend with the myriad difficult and thankless tasks associated with caregiving, but most also have to work outside jobs in order to pay the bills. In all, more than 70% of caregivers effectively work two jobs.

Teacher Man @ My University Money writes Why Do Professors Have Such Long Booklists? – One key trick that I learned while going to university (and also one we pointed out in our book), is to go to the first few classes before you plunked down hundreds of dollars of textbooks for a course.

John @ WILD about Finance writes Video: What is a Fixed Rate Mortgage? – Everybody talks about them, but are they best for you? BagMan has bags of knowledge and will explain all in this video

Thomas @ Finance Inspired writes Cut the costs on your weekly commute to work – with a few small changes you can save a little bit of cash on a daily basis just by following 3 simple steps

Jules Wilson @ Fat Guy,Skinny Wallet writes My First Trip to a Running Store – I started running back in October, and I knew that shoes were important. They are the most important piece of running equipment you could have.

Peter @ Bible Money Matters writes Should a Christian Lend Money and Earn Interest? – I think a lot of people’s first reaction to the question “should Christians lend money”, is that Christians should not in fact lend money.

Investor Junkie @ Investor Junkie writes Investing Forum Now Live – I am happy to announce the Investor Junkie Investing Forum is now live. The reason for me wanting to create this forum – I was getting frustrated with many of the other investment forums out there. The signal to noise ratio seemed high on some of the forums.

Joe @ Midlife Finance writes Five Tax Tips: Past, Present, Future – If you’ve been Johnny-on-the-spot and kept careful records every month all year long, feel proud — and smug. Tax preparation should be fairly easy for you.

Nick @ A Young Pro writes Finding Your Passion – Back when I was applying for every job I could see I was also taking every interview that I could. I learned a lot from those interviews, and one of the first lessons that I learned was to show passion. Potential employees that are passionate stand out from the crowd. If you are energetic, enthusiastic, and can talk intelligently about certain topics, employers will notice that you are in it for more than just the job.

John S @ Frugal Rules writes 4 Simple Ways to Make Filing Taxes Easier Every Year – Very few people enjoy doing and filing their taxes. However, with a few simple steps you can make the process easier every year.

Will @ Card Guys Blog writes How to Choose the Best Balance Transfer Credit Card – As you determine which balance transfer credit card is right for you, it’s important to consider some of the factors. Here’s what to look for before you apply for a credit card:

Jon @ Novel Investor writes What Is Preferred Stock? – When people discuss stock, they are usually referring to common stock. But preferred stock is another type and it is popular with income investors.

Glen @ Monster Piggy Bank @ Monster Piggy Bank writes Forex Currency Trading Basics For Beginners – Part 2 – Learn to create a Forex demo account, understand the Metatrader 4 application and start trading Forex.

KK @ Student Debt Survivor writes Put College on Hold & Get a Job – At age 18, did you know what career you’d want to do for the rest of your life? I didn’t. Should we encourage high school grads to put college on hold for a few years until they, “figure it out”?

Grayson @ Debt Roundup writes Who Do American’s Look To As A Financial Mentor? – As the US economy and the economies of the world sputter along, who can we look to as a financial mentor? Spending and consumption is out of control and we need help.

Steve @ Grocery Alerts writes 10 Secrets about Target Canada to save you more money – We are excited to see Target come to Canada. Here are 10 secrets about Target that most Canadians don’t know yet.

Steven @ Canadian Personal Finance writes Five sure-fire signs that you need a new job – Here are five sure-fire signs that you’re in the wrong job – and that it’s a high-time you started looking for a new one.

Jason Hull @ Hull Financial Planning writes Stock Picking is No Better Than Sports Betting – This article examines how you could be fooled into thinking that you could pick horses or pick stocks and the psychological triggers behind this phenomenon

Michelle @ Making Sense of Cents writes How to Transition Back into the Workforce After a Long Period of Unemployment – At least one time during most people’s working career they will find themselves unemployed. Whether it’s due to company cutbacks and workers layoffs, or due to the employee being fired, these normally hard working people find themselves forced into job hunting.

Alexis @ FITnancials writes Inexpensive Fit Activities – Being fit doesn’t have to be expensive, and it can actually be free in most cases. If you don’t have money for the gym, don’t go to a gym then.

Mr.CBB @ Canadian Budget Binder writes What My Life Is Like With Terrible Credit – Bankruptcy may be her only option so she can get a fresh start with her personal finances. She is tired of just existing and wants to start living. An emotional yet inspirational story of one CBB fan who hopes she can inspire others to take control of their debt and start budgeting like she has.

FMF @ Free Money Finance writes Confusion with Precious Metal Pricing – I noticed there are a TON of commercials for gold and silver investing. After a while I started keeping track of the advertisements, wondering what the difference would be from one company to the next. Service? Shipping? Something else? I thought that pricing would be the same. Boy, was I mistaken. I decided to do an experiment.

Deacon @ Well Kept Wallet writes 3 Unique Ways to Save Money – Do you like saving money? Who doesn’t, right? There is no reason to pay more for something if you don’t have to. There are so many ways that you can save money whether it is coupons, discounts, promo codes, you name it. Here are three unique ways that I have found to save money.

Philip @ PT Money writes Business Ideas that Work Usually Scale Efficiently – If you’re considering beginning a new business or growing one you already have, it’s important to consider the scale of it. PT breaks down what “scale” is and how to analyze your business idea in light of it.

Jacob @ My Personal Finance Journey @ My Personal Finance Journey writes The Top Online Savings Accounts with the Best APY – This post gives brief descriptions of several of the top online banks, so that you may make an informed decision as to which bank may be appropriate for your financial situation.

Mike @ The Financial Blogger writes Two Interesting Strategies For Making Money – How to make some moves with a side business.

Div Guy @ The Dividend Guy Blog writes All You Need To Know About Selling Your Stocks – Should you sell a loser? When should you sell a winner?

Arnel Ariate @ Money Soldiers writes Dealing with Debt After Losing Your Job – Learn how to be debt free. I made my final loan payment in February of 2013. It was two years, to the month, after I had lost my job. Now when I buy something, I appreciate it even more because it is a well-earned treat and not a wasteful indulgence.

Thanks for inclusion and hosting, I really appreciate it.

Are you an international spy Mr. Bond? Cool pic and can’t wait for the rest of them. Thanks for hosting and including me. Is it my imagination or are these carnivals getting huge? Thanks again!

If I haven’t said it already, I am JEALOUS that you got to go to Moscow. 🙂 I’ve wanted to go for some time, but my wife says I am nuts. Anyway, thanks for hosting & including my post sir!

What a lovely photo, can’t wait to see more. Thanks for including my post!

Well, it sounds like you had a great reason to step away from the blog. I wish I could have been there and I look forward to more photos. Thank you for including my post.

Cheers – will be following soon 🙂

Thanks for the mention! Hope you’re having a great weekend.

Cheers dude! Been good – back from Moscow at last 🙂

Thanks for including my link 🙂