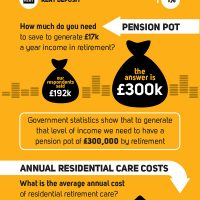

Research from 247Moneybox.com shows that Brits aren’t too worried about retirement, and many underestimate both the costs of residential care, and how much they should have in their pension pot in order to live well in retirement. Respondents underestimated the pension pot size required to generate £17,000 a year income by £108,000 46% of… Read more

Viewing category: Money

New Home Designs: Complete Renovations before Moving In

Moving can be pretty chaotic no matter what your situation is. It is important to take the time to figure out a plan that works for you and your family to make your move successful. Before you transition into your new home, it makes sense to complete certain renovations ahead of time to make… Read more

How to make the most of your inventory

If your excess inventory is choking your cash flow, it’s time to look seriously at inventory management procedures and practices, such as purchasing barcoding equipment and taking your inventory live. It might seem like a big step, but it’s actually a series of small steps that will get you where you want to go. Basic… Read more

Over a third of people aged 45-54 believe registering to vote will improve their credit score

A new study, conducted on behalf of leading prepaid current account provider icount shows that the older generation of Brits are more savvy when it comes to taking action to improve their credit rating, with over a third of 45-54 year-olds believing that registering to vote will improve their credit score. What does this generation… Read more

Do You Find Motor Insurance Too Complex?

If you find motor insurance too complex to understand, you are not alone. About half of motorists (48%) find motor insurance confusing, according to a recent Co-op study. UK drivers said they were mostly confused about how premium is calculated (51%), why prices change annually (43%), what isn’t covered (39%), and what is covered (28%)!… Read more

A Brexit Guide For Small Businesses

Have you made up your mind about the Brexit vote already? There is little time left! If you are a small business owner and still unsure about how to cast your vote, check out this infographic that takes a look at whether Britain should take the plunge and ‘Brexit’, or remain in the EU. The… Read more

10 Things to Know Before You Take Out a Cash ISA

With the UK economy finally getting back on its feet after the economic slump that plagued most of the last decade, it’s time to start making your money work for you. According to data supplied by HMRC, as many as 16 million Britons already had a cash ISA back in 2014. To join that increasing… Read more

Save on travel and become mortgage free faster.

This post was written in collaboration with the Bank of Scotland Over the past couple of weeks, we have been talking about paying your mortgage off early with ideas for making small savings that can really add up over time. By making small monthly overpayments, you could save thousands in interest on a 25 year… Read more

Benefits of Increasing Your Credit Limit

You may think that having a credit limit sucks. Why would you want to have a limit on your generous weekend shopping spree? You will pay for all of it after all. But having a credit limit has an upside. There are benefits when your credit card has a limit. Increasing your credit limit may… Read more

5 REASONS WHY YOU SHOULD START PLANNING YOUR… CHRISTMAS TRIP NOW!

Yes. I know. It is only the middle of May, and it seems like Christmas is not coming soon, but in fact, if you wish to travel around the jolliest season of the year, you should start planning your trip just right now! Why? Well, there are at least five good reasons, and let me… Read more

Forex and Stocks: What are the key differences?

The forex and stocks market are without a doubt two of the most popular markets in the world, each have a large number of participants on a daily or business daily basis. While you tend to hear more about the stock markets on your TV, it is in fact the Forex that is considered the… Read more

5 ways to make money online

This post was written in collaboration with Opinion Outpost. Today, let’s explore a few of the ways you can earn money online from the comfort of your home. Making money online isn’t easy, it requires effort and persistence, but it can be much more flexible, if you are a stay at home parent or instead… Read more