Today, Bangalore might just be known as The Silicon Valley of India, but only a few are aware that it was once ruled by several dynasties. Bangalore witnessed the era of Tipu Sultan, who ruled the Kingdom of Mysore from 1782-1799. The rule of Tipu Sultan gifted Bangalore with architectural wonders including the Bangalore Fort… Read more

How You Can Save Money On Healthcare

One benefit of living in the UK is the National Health Service, a public health service which provides free healthcare to UK citizens. While this covers the majority of a person’s healthcare needs, according to the Office for National Statistics, the average UK person spends around £2,000 on healthcare every year; a number that is… Read more

The Online Evolution of Buying

In 1995 people were amazed at being able to join an online chat room from their mammoth desktop computer. Fast-forward 20 some odd years and people are walking around with tablets and stepping into virtual realities with their phones. One of the most dramatic shifts has been how consumers shop. Almost overnight an entire world… Read more

SavvyScot Special: Get £10 Cashback when you switch energy provider

Scroll down for details about our exclusive £10 cashback offer on your next energy switch! Are you paying too much in utilities? When was the last time you did a comparison search to make sure you are on the lowest tariff? Utility companies generally offer a very attractive rate to new customers for the first… Read more

Possible reasons why your personal loan application got rejected

Gone are the days when you had to wait indefinitely before buying a home, spending on education or planning a wedding. You can now depend on IndusInd’s Personal loans and, by following a few simple steps, you will be on way to comfortable consumer banking. While personal loans are unsecured loans and you only need… Read more

Tips for Creating and Keeping a Budget on a Single Income

Whether it’s a temporary situation, or a long term position, budgeting on a single income can be tricky. Here are some hints and tips to make it easier. Before you begin, keep a spending log of all purchases and expenses for the previous month. Using this list, sit down with your spouse and discuss the… Read more

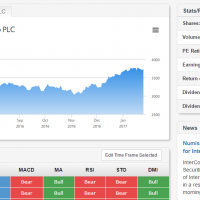

Tips to get started with investing

We have made the case for investing versus just saving money many times here at The Savvy Scot. Why? Returns. Simply put, these days a “high yield” savings account will give you 1 or 2% interest per year. That is barely enough to keep up with inflation. On the other hand, the S&P500, an index… Read more

4 tips to reach your money goals + a chance to win £5,000!

As a finance blogger who talks about money all the time, I tend to consider that I am pretty good with all things money. But looking back at 2016, I realised that it’s been a decent year, though nothing extraordinary. You know why? I didn’t set goals. I just went with the flow, saved money… Read more

Are Money Market Accounts Safe?

You work hard to earn your money and want to keep it safe. With so many options for investing, how do you find out which one is the best for you? If you are interested in a money market account, continue reading to find out if it is right for you. What is a… Read more

Benefits of Buying Tax Liens Through an Online Auction

As is the case with just about any investment, there are a range of ways you can go about purchasing a tax lien certificate. A tax lien certificate is placed on a property by the government when the owner fails to pay their property taxes. Purchasing the lien certificate gives you ownership of the debt… Read more

Credit Poor Advice: Should You Apply for Wonga Loans?

Have you thought about applying for a short-term loan? You probably have! Nowadays, most people tend to consider going down that road every now and then. Financial difficulties are affecting most families, and monthly expenses are taking over most of their salary. Whether you intend to reimburse a persisting debt or you are short on… Read more

5 Items to Exclude From Your Wedding Budget

Your wedding is one of the most important days of your life. It is also one of the most stressful days to plan for. Help reduce some of that stress and your budget by excluding these items from your wedding budget. Save The Date Cards Save The Date cards were once a way… Read more