Long term readers of Savvyscot will know that I like to invest. In fact, all money that I have made from this blog to date has gone directly into the stock markets, in one form or another.

When I first start out investing, I had to consider how I was going to do this. Given the volatile nature of investing, there is definitely not a perfect strategy, but looking back there are definitely some that are more sensible than others. For example, would you put all your money in a single company?…. hopefully not. Or would you put all your money in penny stocks?…. again, hopefully not. My strategy was to follow the one thing that I had heard time and time again – diversify diversify diversify!

But how to Diversify?

One of the first things that comes to mind when you think of diversification is to split your money across lots of different companies. The problem with this approach is that unless you have a lot of money to begin with, this can be very uneconomical. In the UK it can often cost around £10 per trade in trader fees and then you have government stamp duty on top. I saw that the key was to minimize the number of trades, but maintain a variety of different investments. Quite contradictory huh?

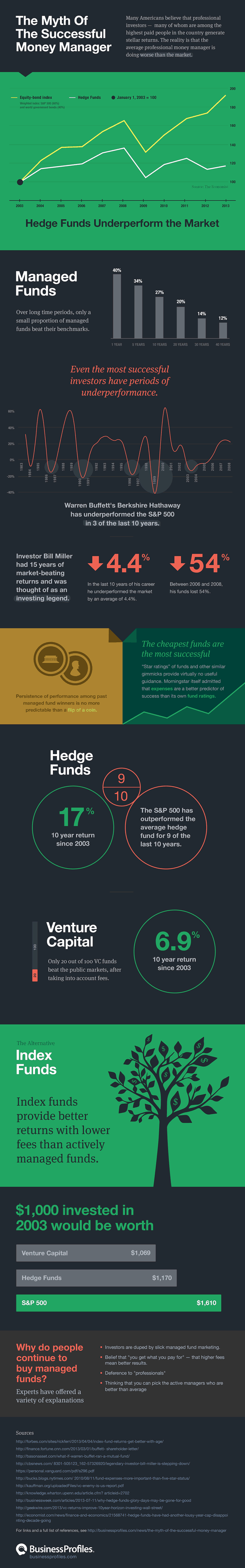

This led me to look at two main options – Using a Fund Manager, or Using Index Funds. Fund managers are paid a LOT of money to managed a portfolio of funds. They proactively research companies and make strategic investments on your behalf. Effectively they get paid a percentage of your investment annually – regardless of whether you have won or lost over the past year. On the up side, SOME funds perform very well – far out-performing the market average. Other funds do VERY badly and you can lose a lot of value.

Index funds are a sort of tracking fund – where stocks are bought from a variety of companies in the market in an attempt to mirror the market average. It is a much safer bet, but doesn’t have the high-risk, high-reward element.

The following Infographic from Business Profiles is quite a powerful comparison….

Which would you choose?

Hey Mr Scot… just discovered your blog, looks good!

Have you done any posts detailing exactly what you are invested in, how long, returns etc?

I’ll have a look around of course… just being lazy 🙂

Cheers