This post was written in collaboration with Aviva.

Aviva has just launched a campaign to help Britain save more money. So naturally, at The Savvy Scot, we wanted to know more. Saving money is one of the best gifts you can give your future self and your family. Sometimes, you don’t know where to start, or even how to do it. Maybe finding out what your financial personality is will help define your saving or spending patterns, and find out the best way for you to maximise your savings.

I proceeded to take the test, which first asks you a few for your age, sex and location.

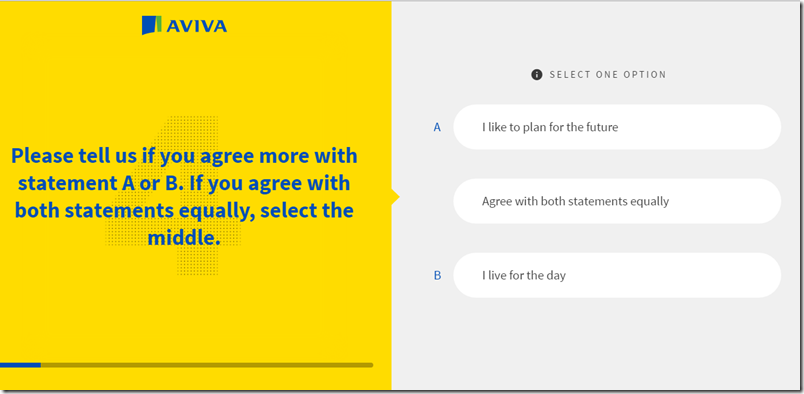

You are then taken through a series of questions to define your personality in general. For example, do you like to live for the day or plan for the future is a personality trait in all aspects of your life, but it can affect the way you view money. Long term planners are more likely to save for a rainy day.

The test asks you questions about your money habits compared to that of other people,

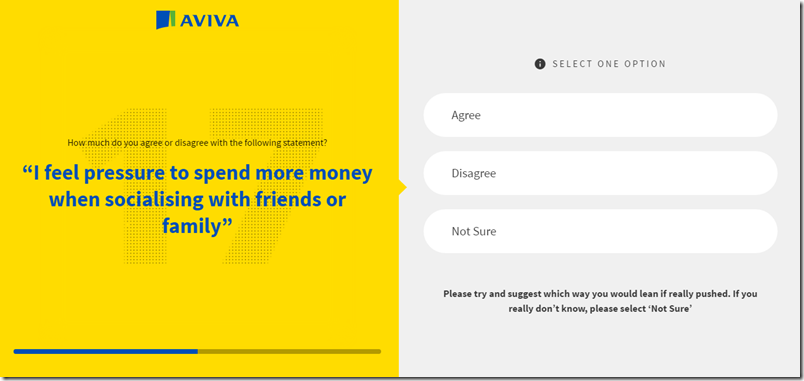

or how your friends and family members impact your spending.

I found it covers a lot of areas of our finances that we don’t necessarily challenge or pay attention to. Say your friends are talking about going out on Saturday, you would go where the group has decided to, and probably spend more than you can afford, without realizing that is because you were in a dangerous environment, while on your own, the spending wouldn’t happen.

Another interesting statement was the following:

That is clearly meant to find out whether you can afford your lifestyle or not. Lots of people make it on a small budget in expensive cities. However, I did answer yes to that, even if I can comfortably afford my lifestyle, I find life pretty expensive these days.

The question about convenience also made me wonder. Of course, now that I am a bit older and have more money, I am willing to spend more for convenience. Take a taxi to the airport, order take-out… but that doesn’t mean my spending is reckless. People spending daily on convenience because they’re too lazy to go to the supermarket or cook a meal at home however, can end up spending way too much.

But I guess the test was smart enough to realize that, since I was declared a Turbo Saver, in spite of my love for convenience and little splurges. They are, after all, what makes life interesting.

Apparently, my financial personality is very confident, even a little too much at times. Saving money comes easy, but over-confidence can mean I might have lost opportunities along the way.

Find out what your financial personality is on Aviva’s website. If your personality is more on the spending side, and you want to learn how to #savesmarter, stay tuned next week for tips about maximizing your savings without affecting your lifestyle.

Before going on a financial loan or anything, it needs first to be determine whether you are valid enough to undergo in the financial world. Taking this tests means to determine how you be able to handle those situations that you are going into. This would serve as a measurement of your capabilities so take this seriously. And make a resolution to it.