Personal Finance is freaking boring!!!!

From the outset, personal finance is exactly that – boring. A mundane administrative task that nobody wants to do. Most of us sit in front of spread sheets all day at work – why would we want to come home and start again? We all have different financial situations, but in the purest and simplest form personal finance is not exciting.

Personal finance essentially involves taking a high-level look at your finances; a process of checking that you pay bills on time and (in general) spend less than you earn. I’ll say it again, the fundamental rules of personal finance are SIMPLE!

- Pay your bills on time

- Ensure that you have enough money in your accounts to pay said bills

- Ensure that you can keep replacing the money in the accounts so that it will never run out

- Diversify the replacement methods such that if one fails, you have backups

The fundamental principles of personal finance are remarkably easy… even an idiot can understand them; Spend Less Than You Earn. A Lot Less! Unfortunately, as easy as that may be to understand, we live in a world that is trying to trick us. From lucrative advertising that is trying to make us all fall in love with the latest gadget, to the easy availability of credit… they system is trying to catch us.

The System is Trying to Smash the Equilibrium

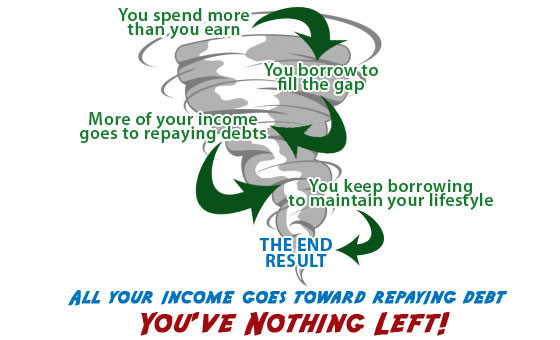

People run into financial trouble for a number of reasons. The high-level view is simple. The required spending does not equate to the income (for some reason or another). Whether it be that the spending increases to a level that the earning simply cannot compete with, or the earning capacity suddenly reduces or even stops altogether; the principle is the same:

The spiral is so easy to get into and so very difficult to get out of – a single loan can start a chain reaction – and if you are not careful, may never let you go. The Butterfly Effect

From a young age, we are tempted with lines of credit – ‘free money’ – which flicks a switch inside our heads. It feels so damn good to buy things and especially without having to go to the effort of working – putting in the graft – beforehand. Subconsciously, we put the associated negative feelings of owing money to one side and continue down the glorius path of spending. We ‘treat’ ourselves to a new item of clothing, or a night out with our friends to celebrate an unknown occasion. All this time, trying to keep those negative feelings of debt on the sidelines, in the backs of our minds.

It Can’t Be That Bad… The Banks are Offering me More Money

Wrong. The banks will continue to lend us money the more we go into debt. We suddenly fit the profile of a dream customer and an analyst has predicted that we have the potential to end up paying a lot of interest. I would go as far as to say that if the banks are offering you interest free credit or to extend limits, then it is a warning sign that you may be getting into trouble. You see the thing is:

If we were all responsible and paid our credit card balances in full each month, the banks would not make money from them. In fact, the banks would start to lose out so badly that they wouldn’t be able to afford to offer the same attractive rewards and cash back deals that are available today. Those of us who do pay back what we owe in full are being rewarded by the misfortune of others.

Make the Change

What I am essentially saying is that not everyone will pay of their debts and become financially responsible – but you can. Not everyone will get this message – but you did. Not everyone will pay attention – but you might.

It is about time that you started benefiting from the Perks, rather than funding them. You need to start by Making Personal Finance Exciting. You need to realise that the spreadsheet that you have (or don’t have) at home is the most freaking important spreadsheet in your life. You need to take responsibility and finally start realising that you need to SALLTYE – Spend a Lot Less Than You Earn.… The lesser the better.

Do you know anyone that doesn’t follow the SALLTYE principal? Any EXTREME examples?

image credit – moneysavingexpert

Great post savvy. I think this speaks volumes. The fundamentals of finance are extremely easy to understand, but we all have the external forces pushing against us. We have to be the ones to push back.

Grayson @ Debt Roundup recently posted..Save For Retirement or Pay Off Debt?

Thanks a lot Grayson! I agree… and let’s keep entertaining people along the way 😀

So, if I like personal finance does that make me a nerd?!? 😉 Seriously though, great post…spot on! I have a family member who tells me that they don’t believe in budgets. Ok, they may not be for everyone and I get that. But, they tell me they just spend whatever they want and hope that their bank account is still positive at the end of the month. I just want to shake them!

John S @ Frugal Rules recently posted..10 Ways to Stretch Your Grocery Budget

You can be a nerd with me John – Thanks for the Kudos though! That is unbelievable – I know a few people like that too and it winds me up something rotten!!

Great Post! Ya personal finance can be boring but it can be exciting to learn as well. I always say “It’s not about how much money you make it’s how you save it” or essentially spend it. You are right it is common sense but not everything is as common as it should be to some people. Mr.CBB

Canadianbudgetbinder recently posted..The Grocery Game Challenge Dec 10-16, 2012 -2 Weeks Until Christmas!

Thanks dude… Lucky there are some funny and entertaining PF bloggers out there to help spread the message huh?! 😀

That cyclone picture is spot on. Sometimes you feel like you made it out of the twister just to be pulled in again.

Justin@TheFrugalPath recently posted..Credit Cards: Do You Spend More With Them?

I was thinking the same thing Justin. It’s a bit sad really 🙁

Glen @ Monster Piggy Bank recently posted..Has Christmas Become too Commercial?

True Dat

🙁

Great post Savvy. I was a slave to my personal loan and credit card until a few months ago. A weight I didn’t know I was carrying had been lifted!

But your right, I was brought up to think that credit cards and overdrafts were an accepted way of life which got me in the mess to begin with!

What irritates me now, is whenever I pop into branch they try and sell me another loan!?? They didn’t even bother to try and drop it into relevant conversation like “Oh I’m sorry to hear of your car troubles, maybe a loan would be a quick solution to this?”

Nope, offered it to me like sweets at a Weight Watchers party! I was really annoyed! They could see I had just paid it off!

Trying to claw me back in!

Thanks Rachael – I know just what you mean about the weight being lifted. It is quite amazing the feeling of relief you get! I think the western world has become too accepting of debt and as you say – staff are given huge incentives / targets to sell products! Don’t let em get you back!!

“Spend a lot less than you earn.” That is most likely the best financial advice that you can give anyone! It is the key to freedom, really.

Absolutely. The most powerful things in life are the simple ones… We’ll get the message out eventually!

Great post! I need to print out a sign that says “Spend a lot less than you earn” and read it every morning for some motivation.

Ashlee recently posted..Oh, Christmas Tree – 2012

Hey Ashlee – sorry for the delay in the response – had a lot of comments! That is a great shout – maybe on a small piece of paper in front of the mirror where you brush your teeth, or as a reminder on your phone / background. 😀

I think the idea is a lot easier understood than executed. It’s sort of like saying, well all you have to do to lose weight is diet and exercise. duh! But look how many people fail. I still struggle with spending less than I earn, mostly because I earn so little. I’d like to do both of those things. Spend less, but earn more. Actually not true. I wouldn’t like to spend less than I am right now because it’s not that much-I really want to earn more, but not go crazy with spending.

Budget and the Beach recently posted..Looking Back, Looking Forward: Part 1

That is a great Analogy to the weight loss – love it! Keep up with the blogging and you will be rolling in it come 2013 🙂

You’re right, Scot, personal finance isn’t very sexy. But if you follow the basic principles for long enough, especially SALLTYE, you’ll end up so rich you’ll be the one who’s sexy!

Drew @ Objective Wealth recently posted..A Christmas Carol? Bah, Humbug!

Together Drew… we will MAKE IT SEXY!!! 🙂

I don`t know I think PF is pretty sexy. Thousandaire did a whole music video on it. Girls like financially sound guys 🙂

Mandy @MoneyMasterMom recently posted..Do you dare to dream?

Oh I do too… but only when a certain few people talk about it… too many boring bloggers! (present company excluded) 😉

Great post. For me I have learned to spend less than you earn the hard way. In hindsight, I should have paid attention to the boring stuff and saved myself the debt. Not everything in life that is important is fun. Simple as that.

Miss T @ Prairie Eco-Thrifter recently posted..How To Throw A Lavish Holiday Party On A Tight Budget

Thanks! I bet it is a lesson that you have learned for good now though!

Funny. Everything is boring from the outset unless it has frosting, cheese, or pretty lights (in that order).

The fun in financial planning is in digging into the numbers. I remember meetings with new clients would begin with them bored to tears. My goal (and I succeeded a fair amount, I’d say!) was to excite them about the topic. Of the planners in my area, my “show ratio” (percentage of clients who didn’t cancel meetings) was usually highest. That’s not because I’m some brilliant dude (well….that COULD be it), but it was because I’d dig in enough that we’d find money in the details. Clients would love to build a plan together that they could see.

Actually, I might even call those meetings “sexy.”

Thanks for getting me fired up.

AverageJoe recently posted..The Worst Gifts Ever: Crystal Frogs, Re-gifted Candy and More Bad Holiday “Fun”

Hahaha! You got me laughing here – frosting cheese or pretty lights – I like that!

I like it! Get some passion behind you and in your case and you can literally do anything and make anything fun. I seriously believe that – 100%!!!

Yes, personal finance can really be boring. But this is beside the point. You composed it so well.It is all a matter of being responsible such as paying credit card balances completely and promptly. Let us all learn about the rudiments of personal finance.

Absolutely! Cheers David

I am considered extreme by most because I have left the corporate world at 29 and I do spend much less than I earn but still have fun on the way!

Extremely Cool maybe

I love SALLTYE. Last year we lived off 23% of our income. Boo Yah, it feels great!

Derek @ Freeat33 recently posted..Rant; What is your legacy saying about you?

That is INCREDIBLE!! Good job dude!

I love the simplicity of that saying! I know a lot of people who spend more than they earn, and they probably don’t even realize it! I spend about 50% of what I earn – and it feels great.

Jordann @ My Alternate Life recently posted..Getting the Most Out of My Budget

Think we can start a following with it? …. Nah me neither but it is quite cool! 50% is an awesome figure – kudos to you

Great post. If only everyone followed the SALLTYE strategy, the World would be a much better place!

In my experience, some people ignore SALLYTE and go down the insolvency route too quickly without giving due thought about the future impact of this.

As a contractor accountant, I love the “You need to realise that the spreadsheet that you have (or don’t have) at home is the most freaking important spreadsheet in your life.” comment.

I suggest to my contractor clients that whenever they update their spreadsheet they reward themselves with a pint of real ale, glass of wine, bar of chocolate or some other little treat. That way the task soon becomes associated with the treat and is much more appealing!

Bryan

Bryan recently posted..The Autumn Statement – What impact does this have on Contractors?

Cheers Bryan 🙂 – Happy New Year

I have to agree with Grayson that finally “The fundamentals of finance are extremely easy to understand” but although we all know what we have to do with money, finance but also other aspects of our life at the end of the day we loose our focus and we do mistakes small or bigger! It looks that mistakes goes with the nature of human race…

I agree Vaptisi! Here’s to making less mistakes in 2013! 🙂 Happy New Year