Happy Sunday everyone. The spammers have been out in force this weekend – I understand that numerous GoDaddy hosted blogs have been compromised. The hack basically involves spammers infecting the WP-INCLUDES folder with malware and leads to Google red-listing your blog. This is bad news for any blogger as it basically puts-off 99% of visitors with warnings and alerts. As promised, I will be writing a post this week to outline the remediation steps. In the meantime, I am seriously considering migrating my hosting.

There are so many advantages of using a smaller (independent) hosting company. By using a company like Godaddy, you might be sharing a server with some BIG sites. Although you may have unlimited bandwidth, in reality this is restricted and will vary depending on traffic on the other sites that are co-located on the same server. High traffic to a news / sports site might lead to a delay on yours! Most of the independent hosts will lease a Virtual Private Server or Private Server from one of the big hosts and then sell space / bandwidth to other clients. They are essentially a middle-man who can control exactly who and what can be hosted on the server. Because companies like GoDaddy make huge profits on hosting, the smaller companies can offer competitive pricing; especially when they are well established and have a few sites already on the server. If you are considering starting a blog, I would highly recommend giving this some thought. More to come….

I spent the day yesterday painting our spare room (a long overdue task since moving into our new house back in March) with Mrs Scot and her parents… our ‘feature wall’ in a different colour added huge complications to the taping and touching up process!

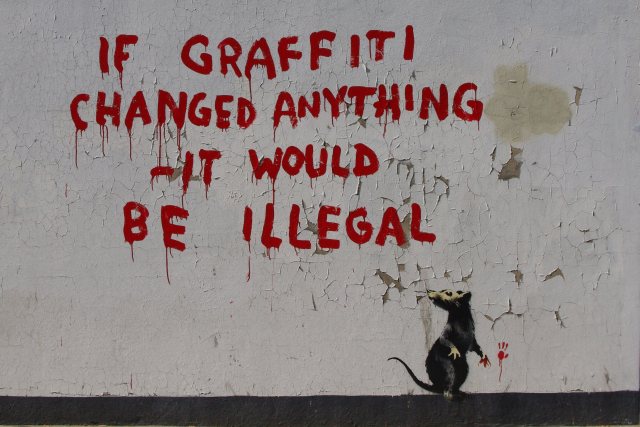

Does anyone else love Banksy?

So here it is folks… grab a cup of coffee, lunch and dinner – it will take you a while to get through all of these! 🙂

BUDGETING

Steve @ 2014 Taxes writes Getting Your Taxes Done with TurboTax Canada – TurboTax Canada is the software that every person should take advantage of when it comes time to sit down and do your taxes.

Martin @ Studenomics writes How You Can Be Your Own Travel Agent For Your Next Epic Trip – 2,000 words on how to plan your own trip.

Matt @ Living in Financial Excellence writes The Wow Factor: Getting the Most Bang for Your Buck – When you think about making a purchase, have you ever thought about rating it on a scale of 1 to 10, with 1 barely moving the needle and 10 being a big, exciting WOW?

Grayson @ Debt Roundup writes The First Step to Recovery is to Admit You Don’t Have a Budget – When you have any problem, the first step to recovering is to admit the problem. The same goes with money. The first step to getting your finances in order is to admit that you don’t have a budget.

BUSINESS

Mike @ The Financial Blogger writes Part4: Investment Strategies To Make Over $200 With Your Newsletter THIS Year – A strategy worth trying out for your newsletter.

JP @ My Family Finances writes Net Worth TV on How All Business Can Leverage the Global Economy – Here at Net Worth TV with Terry Bradshaw we look at and discuss all aspects of business. Today lets look at how you can leverage the global economy.

Jen @ PF Carny writes Steps to Determine If You Are Ready to Open Your Own Business – If you are working for “the man” at a 9 to 5 job, you may dream of nothing more than venturing out on your own and being your own boss. This is the true American dream, and in this age of the Internet, it has become a reality for many people.

MMD @ My Money Design writes Believing In Yourself After Finding Out That You Suck – Despite what other people think of you, believing in yourself will have to come from your own hunger and ambition. Only you know what you’re capable of accomplishing.

Jason @ Live Real Now writes Making Extra Money Part Three: Product Selection – My niches site are all product-promotion sites. I pick a product–generally an e-book or video course–and set up a site dedicated to it. Naturally, picking a good product is an important part of the equation.

CAREER & EDUCATION

Emily @ PT Money Personal Finance writes Twenty Best Part-Time Jobs with Benefits for 2013 – It might be more difficult to find companies that will offer benefits to workers, especially with the upcoming changes with the Affordable Care Act, but we know of 20 companies who do.

Ted Jenkin @ Your Smart Money Moves writes How To Read Your Investment Statements – You have a college degree from a good four year school. Perhaps you went on to get an MBA from a fantastic post graduate program.

Daniel @ Sweating the Big Stuff writes What Was Your First Passion Project? – My first passion project was my blog that I worked on for 40 hours a week while bored at my day job. What was yours?

Robert @ Entrepreneurship Life writes Project Management Courses and Training – This course provides people attending it with such opportunities enabling them to become more confident and persuasive.

FINANCIAL ADVICE

Debt Support Trust is a registered charity providing debt advice across the UK. The debt advice team provides a range of solutions including debt management plans, debt arrangement schemes, trust deeds, IVA and bankruptcy

Glen Craig @ Free From Broke writes Why Getting a Large Tax Refund is Bad – Large income tax refunds are fun to get but you would be better off without them. Read why getting a large income tax refund may not be the best for you.

Marie at FamilyMoneyValues @ Family Money Values writes Review of: Family Fortunes How to Build Family Wealth and Hold on to It for 100 Years – Here is my review of this book by Bill and Will Bonner – a real life multi generation family of wealth, telling how they are setting things up to keep the wealth in the family.

MMD @ IRA vs 401k Central writes Taking An Early Withdrawal from Roth IRA Contributions – You’ve heard you can take an early withdrawal from Roth IRA contributions after five years, but did you know there are specific rules that come with it?

Evan @ My Journey to Millions writes Maybe There Is Yield Out There! Bank Bonuses Offered by Kasasa – I couldn’t ignore a recent article from CNBC on the topic titled, “4% Interest, Without Fees: Too Good to be Checking.” The article highlights a new type of checking account that works with local banks and credit unions.

Pauline @ Reach Financial Independence writes Big city life, is it worth it? – With an average salary, does it make sense to live in the big city? Would you spend 20 years working just to pay for a house?

Jon @ Novel Investor writes IRA Contribution Deadline Almost Here – There is one important thing you need to do before you file your taxes. Don’t miss the IRA contribution deadline for the 2012 tax year.

FRUGALITY

Jason Hull @ Hull Financial Planning writes Should You Just Donate to Charity Instead of Going to IHOP’s Free Pancake Day? – On February 5, IHOP gave away a free short stack of pancakes in exchange for a contribution to the Children’s Miracle Network. This article examines whether or not you’d have been better off simply donating to charity rather than taking IHOP up on their offer.

James Petzke @ This Is Common Cents writes Financial Superpowers: The Automagic Climate Controlled Super Suit – One great frugal idea is to keep your home a little warmer or cooler than most people.

Mr.CBB @ Canadian Budget Binder writes Dumpster Diving- The Top 5 Rules For Finding The Good Free Stuff – Dumpster diving has become something of a hobby for frugal couple Karen and her husband who have found numerous items of value. They have even gone on to sell items they found to make a good profit.

INVESTING

Michael @ Financial Ramblings writes Current Series I Savings Bond Rates – A quick overview of how I-Bond rates are calculated along with an overview of your options. Buy now or wait for May? Click through and find out.

Roger Wohlner @ The Chicago Financial Planner writes 4 Signs of a Lousy 401(k) Plan – It is important that you make the most of any workplace retirement plan available to you. New required disclosures about the costs of the plan and the underlying investments were introduced in 2012 and are a good start. However, 401(k) plans are still a mystery to many of the workers who participate in them and sadly to many of the employers sponsoring these plans. Here are 4 signs that your 401(k) plan might be lousy.

Marvin @ Brick By Brick Investing writes Selling Options — How To Start Your Own Casino – A brief description detailing the benefits of selling options.

Green Panda @ Green Panda Treehouse writes How Wild Are You Willing to Get With Your Home? – A look at strange places to live.

Pete @ Intelligent Speculator writes Cable Companies Are In Big Trouble – We tell you what’s wrong with cable companies.

Kyle @ The Penny Hoarder writes 5 Mortgage Saving Ideas – When it comes to cutting your budget, you probably start with incidental expenses like eating out or having digital cable. But it’s also important to pay attention to what kind of money you can save even on the necessities, like your housing payment.

harry campbell @ Your Personal Finance Pro writes My First Default With Lending Club – With today’s pitiful interest rates, it’s hard to sit there and invest your money in CD’s that are returning 1 or 2 percent. So if you’ve been searching for alternative investments you may already know about Lending Club. But if you’re new to the peer to peer lending scene, you can read my first review of Lending Club here.

Lazy Man @ Lazy Man and Money writes Plugging the Emerging Markets Portfolio Hole – Today’s lesson is simple: check and make sure your asset allocation is what you think it is. It never hurts to revisit it every few months. I thought by buying Vanguard FTSE All-World ex-US ETF (VEU), I had my international exposure well-diversified throughout the world. I was wrong and this is where tools like those from SigFig can be extremely valuable

Cash Flow Mantra @ Cash Flow Mantra writes Net Worth TV Reviews How Investing Strategies Change at Various Employment Stages – Net Worth TV with Terry Bradshaw reviews how different people look at money at different stages in their lives. This is important, because the money situations at each stage really are different, and you can’t just put a single template over someone’s entire financial life. Here are some key things to consider at each stage when it comes to investing.

Ray @ Squirrelers writes Is This a Good Time to Invest in Real Estate? – Home prices have trended downward for many years in the U.S., but in some areas things seem to be stabilizing. This development, when coupled with low interest rates, begs the question: is this a good time to buy?

Corey @ Steadfast Finances writes Protecting Your Home Investment – Buying a home is a big step for any family or individual. Not only is it difficult to save up a down payment, but it can also be hard to take care of a house for the first time. Proper maintenance and general upkeep is an important part of home ownership. It takes a lot of work, but it is essential to protect your investment.

SAVING

Edgar @ Degrees and Debt writes Saving Money on Gas via Shopping Programs – How to use shopping programs to save money on gas

Mary Rhodes @ Fine Tune Finances writes Are you Saving Money Just to Save? Or are You saving With Purpose? – Human nature dictates much time and money is wasted when we don’t have a goal. This also applies to our financial life, in short your goal your reason for saving, or purpose. If you are saving money just to build up a bank balance you are not likely to be successful at it.

Paul Vachon @ The Frugal Toad writes Winter Storm Nemo and the Importance of an Emergency Fund – What does the massive Winter Storm Nemo have to do with the need to have an emergency fund? In short, everything. Nemo is symbolic of any un-foreseen event that may disrupt one’s income or cause a financial hardship. From a simple power outage to a long-term illness, being prepared to handle an emergency can mean the difference between peace of mind and having your family’s world turned upside down.

Mike @ Do Not Wait writes How Your Family Can Help You With Retirement Planning – How a family can help with retirement planning.

OTHER

Jacob @ My Personal Finance Journey @ My Personal Finance Journey writes You Don’t Know What You Don’t Know – A First-Hand Account of the State of Personal Finance Education – This post illustrates the importance of teaching our children about personal finance from the pen of one a very intuitive high-schooler. It is very important for parents and teachers/adults to get involved now with their children and students so that they can learn these basic principles of personal finance.

Tushar @ Start Investing Money writes New Year, New Financial Goals? – We are now a little over a month into the New Year. The festive season may seem long gone, as is the time for setting New Year’s Resolutions. But it doesn’t mean it is too late to make strides in the right direction when it comes to achieving your financial goals.

Suba @ Broke Professionals writes How to Watch Your Expenses Like a Hawk – You’ve heard it before, saving money – like losing weight – is as simple as watching your inputs and outputs.

John @ Married (with Debt) writes It’s Time Again – Shopping for Car Insurance – My car insurance premium increases every 6 months even though I’ve never been in an accident, so I shop for new car insurance quotes regularly.

BARBARA FRIEDBERG @ Barbara Friedberg Personal Finance writes HOW TO MEASURE RISK & PROTECT AGAINST IT – Measure investment performance, investment risk, & protect against investment risk.

Jon the Saver @ Free Money Wisdom writes Start a Pension Early to Prepare for Retirement – Start investing now if you want to retire someday. It’s too serious of a subject to ignore for that many years.

CAPI @ Creating a Passive Income writes Playing the Inheritance Game for Passive Income – When it comes to inheriting money, there is no other way to do less, or in some cases, more work for what will be considered a passive income. For those who are blessed to be part of a family that has a fortune to pass on, then your entire job in life becomes maintaining your place to inherit the goods.

Amanda L Grossman @ Frugal Confessions writes My Frugal Resume: Contributing to Our Household’s Finances in More Ways than Earning – It’s no secret that I enjoy funneling as much of our income as possible into our savings accounts.

Roger the Amateur Financier @ The Amateur Financier writes Money and Child Raising: Preschool, Yay or Nay? – If you’ve been reading the past several weeks of these Monday posts here at The Amateur Financier, you’ve noticed that I’ve been covering some of the choices

Michelle @ The Shop My Closet Project writes Dear Mr. Postman – For the last few years I’ve noticed that the U.S. Postal Service has been having some difficulties. With the introduction of the internet people have embraced online banking, e-filing, and basically internet everything. We get our bills sent to us through e-billing and it’s a good thing because using less paper is good for our forests.

eemusings @ NZ Muse writes Same old same old money arguments – Money is a major cause of couple fights – and we’re not immune.

A Blinkin @ Funancials writes 99 Problems: Are You a Sort-Of Good Saver? – You may remember me (and other bloggers) mentioning the $999.99 giveaway. Believe it or not, the dollar amount is not completely random. There is a purpose for it.

TDB @ Tax Deduction Blog writes Before You Say I Do : How will marriage affect your taxes? – Before you get married, you should take the time to learn how marriage will affect your taxes. What is this so-called marriage penalty? Is there really such a thing as a marriage tax?

Wayne @ Young Family Finance writes Money and Relationships: Some Advice to Keep in Mind – Talking about money with your spouse can be difficult, but it doesn’t have to be. There are many successful strategies to broach the topic.

Alice @ Hurricanes, Panties & Dollars writes Shopaholics are like Superheros – I ended up spending around 9 hours shopping (with an official shopaholic) by my side. When I finally got home, I was freakin’ exhausted; not to mention broke as…

Tony @ We Only Do This Once writes We Are All Experts – Many people have spent a ton of life energy in a quest to discover their passion. And for many of them, once they found it, that was enough. Finding the thing that lights them up inside satisfies the quest. But some people want more than that—they want to live their passion.

PPlan @ Provident Plan writes How to use stoplosses and limits in spread betting – If you’re a novice in spread betting or any other form of trading, one of the biggest anxieties you probably have is losing money.

Invest It Wisely @ Invest It Wisely writes Weekend Reading, Winter Edition – The forest is situated south of the Loch Achray Hotel.

Mike @ Personal Finance Journey writes Liability in a car accident – Simple easy tips on liability in a car accident to help you minimize your financial loss and keep on the financial journey.

Hank @ Money Q&A writes Ten Ways To Break Your Texting While Driving Habit – There are ways that you can can work to break your texting while driving habit. As you drive, consider when you become bored behind the wheel and inattentive.

Maria @ The Money Principle writes My Father’s only investment – My Dad made only one investment in his life: my education.

Charles @ Wallet Hub writes Your Guide to FHA Loans – Home ownership can be difficult to achieve in today’s market, but it remains an “American Dream” not an “Impossible Dream.” Though requirements have been tightened in the wake of the home mortgage crisis, FHA loans continue to offer a way for persons of modest means to purchase a home.

Jules Wilson @ Fat Guy,Skinny Wallet writes Lessons Learned from a Stolen Wallet – My wallet was stolen, and I learned many lessons from the ordeal. Find out what to do when your wallet is stolen and also how to prevent the theft in the first place

Wonder if anyone made it right to the bottom?!

Thanks for hosting and including my blog. My hosting is through bluehost and so far so good (knock on wood). Have a great weekend.

Pleased to hear you have had a good experience to date…. I am no longer with GD!! 😀 –

Wow you got things switched over fast! One good thing about GoDaddy though is their response time in getting nameservers switched over is pretty quick. I have done that a number of times (buy domain at GD b/c it is convenient and then just point it elsewhere).

ps. Thanks for all the great reads!

Yeah – the Team at Nuts and Bolts took care of it all! 🙂 I will also keep my domains at GD for now… Have you made the switch?

Yup. Point-click-buy-domain. Point-click-point-domain-away-from-GoDaddy lol.

Thank you for including my post this week!

Thanks for hosting & including my post sir! We’re actually moving our hosting over to Andrea next week. I am also having her redesign my site as well. My wife got to speak with her the other night and could not recommend her more. If you’re considering it, I would totally make the move!

Beat you to it – I moved to her last night – SO much faster already. 😀

I was wondering what was going on with your site yesterday when I tried to link up in my Saturday post, I couldn’t. Chrome kept shutting your page down, a big red page popped up saying your page was known for malware but is fine now. Hopefully it will all get sorted. Thanks for hosting mate and including CBB!! Cheers

SavvyScot is now hosted by Nuts and Bolts – here’s to hacking being a thing of the past (hopefully)!! Pleasure on the inclusion

Thanks for hosting and for including my post.

Thanks for the Mention! And thanks for the comprehensive reading list! I don’t host with GoDaddy but I’m looking for your post on how to remediate the WP-Includes vulnerability. I imagine that any WP blog is probably susceptible.

Promise to write it soon 🙂 = I am now no longer hosted by GD either 😀 !!

Thank you for hosting the carnival and including my submission!

Thanks for hosting and including me in the carnival!

Anytime dude

Thanks for hosting this week! Andrea does a great job. I currently host several sites with her and am very pleased.

I am now part of the Nuts and Bolts family 🙂

Thanks for hosting the carnival this week and including my post. I don’t host with godaddy, only register domains there. I setup my blog in the beginning by changing many of the table names so they couldn’t be injected by sql. It has cut down on spam and the attempts to force login my admin panel. There are so many security loopholes with wordpress to consider. I look forward to your post to see if there is anything else that I can do.

That’s good advice on the tables.. cheers 🙂 – I migrated my hosting to Nuts and Bolts last night… wish I had done this sooner! Site is already a lot faster 🙂

Glad to see you’re sorted out again – if you decide to come over, I’d love to have you! 🙂

Just for the record, while many small hosts do resell space on a big host like HostGator or Bluehost, I don’t. I rent a rack on a gigantic server farm in Dallas and my server is 100% operated/controlled by me. The problem with reselling is that you’re still technically “sharing” – the hosts cram as many VPS or dedicated servers onto one physical machine as they possibly can, and only the settings separate one reseller account from another. I don’t like that idea as it’s not significantly different from regular shared hosting and not the best value for my clients.

SOOOO much faster already 🙂

I hate those hackers! So much stress and there’s very little value to them in my site!

BIG time! I am now officially hosted by Nuts and Bolts Media 🙂 –

I also wondered what was going on over here last week mate. Glad to see you’ve got it sorted though! I keep hearing good things about Nuts & Bolts Media but have no Idea of the costs involved.

First reply to a comment on my new host – Nuts and Bolts media! I migrated last night and the Nuts and Bolts team worked through the night to migrate my site over (for free)!!! Blog is faster already and feels more secure 😉

I am alos a bit sick of my current hosting and am getting a self managed VPS so I can finally do all the things I wanted to without having to harass my host.

Plus I can finally run the nginx web server instead of the slow Juggernaut that is Apache.

Found your site through weonlydothisonce.com. Loving it so far and happy to know about Nuts and Bolts hosting. Lunarpages better not eff up now that I have other reputable options. Thanks for the good info.

My goodness, this may be the largest carnival I have ever seen! My reading is definitely cut out for me. Thanks, Savvy!!

Haha it was even bigger when it first arrived!!!