As Prince George turns one (22nd July), the world is inundated with images of a beautiful calm and well behaved little prince. But mums and dads know too well that behind closed doors, every toddler can wreak Royal havoc, especially in the home. In fact, damage by animals and children are a common cause of home insurance claims. With Buckingham Palace now home to both kiddies and the corgis, the Queen will need a good home insurance policy more than ever to ensure the Crown Jewels are suitably covered.

As the nation prepares to celebrate the birthday boy’s big day, home insurance specialist, Together Mutual Insurance, has compiled some top tips on safeguarding the home for those with a little havoc-wreaking prince or princess of their own.

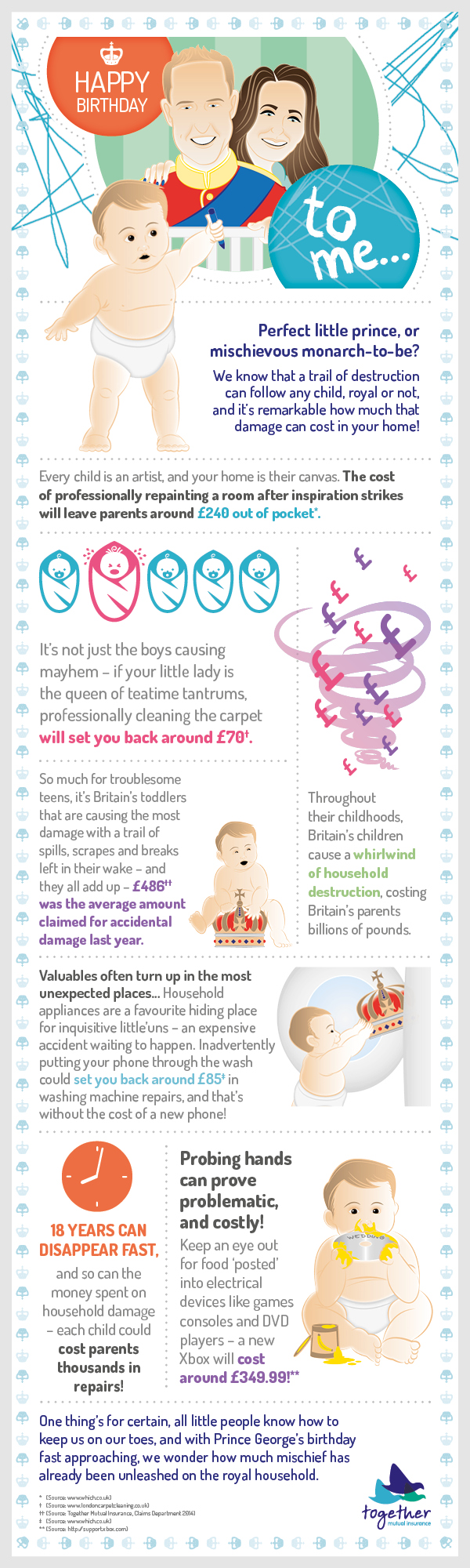

Please find the top 10 tips below, plus a supporting infographic attached, which may be of interest in the lead up to the Royal baby celebrations. If you need anything further, feel free to drop us a line.

Top tips:

1. When selecting the wallpaper and carpet for a room, make sure you consider how easy it will be to clean them. Children love scribbling, especially on walls. So opt for the easy clean wallpaper, or be prepared to display your little prince’s masterpiece for quite some time.

2. Make sure that the little one doesn’t get hurt by baby proofing sharp corners and securing furniture that could topple. But also check that in doing so, you won’t damage or devalue your favourite piece of furniture.

3. Standard contents policies include an element of cover for accidental damage – including stereo equipment and glass-in furniture – but they don’t cover accidental damage to other goods or actual furnishings. So it is worth adding extended accidental damage cover to your home contents policy, or investing in hard wearing sofas. Make sure kids don’t take food on to the sofa and if they are colouring in, that they wash their hands and leave the ALL the pens and crayons in the play area, not in back pockets.

4. Here’s hoping Kate & Wills have insured their jewellery. Little ones love everything that sparkles, and have a nasty tendency of hiding them in the weirdest places. And if they haven’t stowed it away, there’s always the chance they’ve flushed it down the toilet. Keep your jewels and crowns out of children’s grasp and get them suitably covered in your contents insurance.

5. Mummy’s handbag is a treasure trove of goodies, and we’d all love to know what Queenie carries in hers. If the tot gets into your purse, your lipstick and mascara being used as crayons could be the least of your worries. One spilt juice carton could spell the end for the bag and what’s inside. Make sure your bag is closed and kept out of reach.

6. It is said that children are a drain on finances. In addition to their high maintenance cost, tiny tots often like to slip credit cards, crisp £20 notes, cheques and important business cards through the gaps in floorboards. Avoid pulling up the flooring and make sure you have your credit card details close to hand, stored in a safe place away from the big spenders.

7. If your little prince is visiting granny, it might be worth her paying an extra premium for accidental damage cover to be added to her policy. That way, if your toddler knocks over the TV right before her favourite soap starts, you can rest assured that it will be covered.

8. A standard home insurance policy doesn’t cover portable electrical equipment and clothing for accidental damage. So, as much as your phone or iPad pacifies your child, it might be better to get them a child friendly version and to hang your favourite expensive jacket out of harm’s way

9. Keep baby wipes with you at all times. They are great for any messy activities, and can equally be used to clean up minor spills* as well as mucky hands (*Before using wipes to clean furniture and upholstery try wiping in a small inconspicuous area and only continue to use if no adverse reaction occurs)

10. Last but not least, accept that CHILDREN WILL MAKE A MESS! Make sure you’re covered with a suitable policy for if, and when, the worst does happen.

TOGETHER MUTUAL

Together Mutual Insurance is a home insurance provider of individual and combined buildings and contents cover to policyholders throughout the UK. It is the first consumer-facing brand of UIA; a specialist mutual company which has been providing high quality insurance for over 100 years.

As a mutual company, Together Mutual is able to put ‘people before profits’ and all profits are reinvested into giving great value cover and exceptional service to customers, as well as making things better for the wider community.