(source https://www.pinterest.com/pin/498351515000011632/)

Very few people would disagree that saving money is really hard. It requires commitment, patience and emotional stability – traits by far not all of us possess. And still, there is one more thing that makes the process of saving money so long and difficult. Surprisingly, this is lack of specificity. In other words, practice shows it is not enough to start saving “just in case”. In order to make this process more effective, it is necessary to set specific saving goals. You may either work toward several goals simultaneously or concentrate on one specific goal, but the main idea is to start saving for a specific purpose.

What does this mean in practice?

Find a specific reason for saving

As mentioned above, this will make your efforts more effective. If you don’t need money urgently, a good idea would be to have a couple of saving goals, a major one and one or two small goals. As for a major goal, this may be a down payment on a house or a car; saving for retirement or an emergency fund; saving for a dream vacation, and so on. Sooner or later you will need this money, so it is better to start saving in advance. As for small saving goals, this may be a new pair of shoes, a tattoo, a new mobile phone or anything else that is relatively inexpensive.

Set the timelines

Once you set a saving goal and know the amount of money you need, you should create a timeline for this goal. Make sure your timelines are realistic, but still don’t drag them out for decades. To set your timelines properly is very important as it will allow you to control the process of saving and give you additional motivation. Some goals are easy to set, if for example you want to go to Rammstein concert in summer or in Helsinki next year. Others, however, are somewhat harder to set and especially to achieve, particularly if to talk about your retirement or an emergency fund. Although such goals require special commitment, they are still reachable. You may determine, for instance, that by the age of 35 you want to have $50,000 in your retirement savings account. This is a hard but still realistic goal.

Monthly saving goals

The third step is to determine how much you need to save every month. This may be hard with long-term goals, so in some cases it is better to begin with a calculation how much you need to save every year. In this case, try not to make your monthly saving goals too large. After all, this should become your year-long habit that by no means should make your life miserable.

Additional income

If you want to slightly force the events, find a source of additional income and divide everything it brings among your saving goals or just concentrate on an especially important one. If you, for instance, decide to find a weekend side hustle, you could start adding everything you earn to your camera budget. Nevertheless, do not include this additional income when planning your monthly goals. Let it be just a nice bonus. Side hustle is not a single option – this could also be a freelance job, some small business (like cookies baking), or Glenmore Investments or stock investing. Simply evaluate your skills and use your imagination.

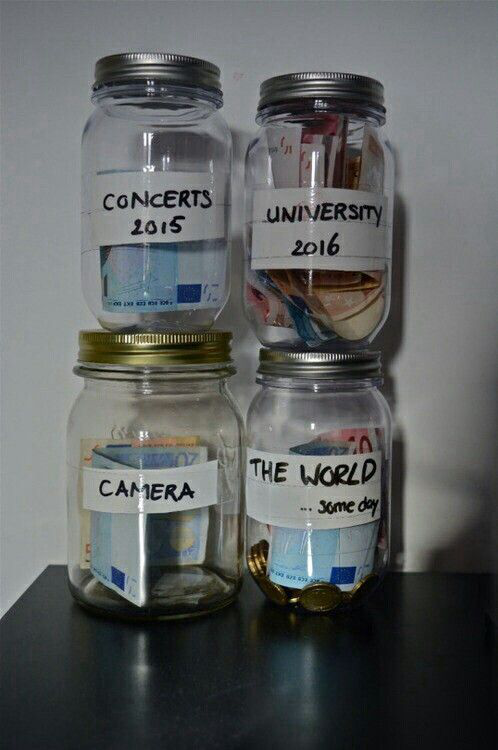

Find a good saving tool

This is not that crucial if you are saving for a new pair of trainers – a glass jar will do. For large goals, however, you will need to choose the right type of account. A good idea would be to open a savings account. Make sure to find a bank or another financial institution with high rates of returns. Also, don’t forget that in most cases the number of withdrawals you can make every month would be limited and you may also be penalized when you make a withdrawal in case the term is not complete. Although the rules may seem strict, this is not necessarily a disadvantage. After all, this will discourage you from unnecessary spending and help you hold to your financial plan.

Reward yourself

Don’t forget about entertainments, even if you live on a tight budget. As just noted, saving should become your habit, but it still should not make your life boring. A party with your friends or the front row theatre tickets won’t cost a fortune, but will definitely help you stay motivated. Finally, even if you are working toward a hard long-term goal, reward yourself as long as you reach some important milestones.

Even if it seems to you that you don’t earn enough to save for anything at all, do know that it is not the matter of small salary. It is more the matter of your self-control and patience – skills you may master if you want. Believe in yourself and you will do this!

I love the jar idea! I also love putting every dime I collect into a jar and then cashing it at the coinstar once the jar is full. It always ends up being A LOT of money!