You might have noticed that it’s been pretty quiet around SavvyScot over the last week or so. As I mentioned a few weeks back, I have been co-writing a book with a bunch of great financial bloggers and yesterday was the deadline! All my writing time has been dedicated to finishing the two chapters that I am responsible for and I am absolutely nackered!

In an attempt to avoid an RSI injury, I neglected you guys – my apologies! Fear not, the passive income series is back with a bang!

Why We Love Passive Income

Why do we love passive income?? Passive Income has to be one of the greatest things ever in life. Something that we can all create to aid our balance sheets, but that few really take advantage of!

The passive income series was created to look at ways to earn cash on the side – how to invest some time and effort in return for a reliable and regular stream of income – with very little ongoing effort required. If you missed the first post, check it out below:

Method 1 – Get Paid to Browse the Internet

Income from Investing

Investing is a very broad term and may well be revisited in future posts in the series. This passive income topic will look at three main areas:

- Investing in Stocks

- Investing in Bonds

- Investing Offshore

Investing in Stocks

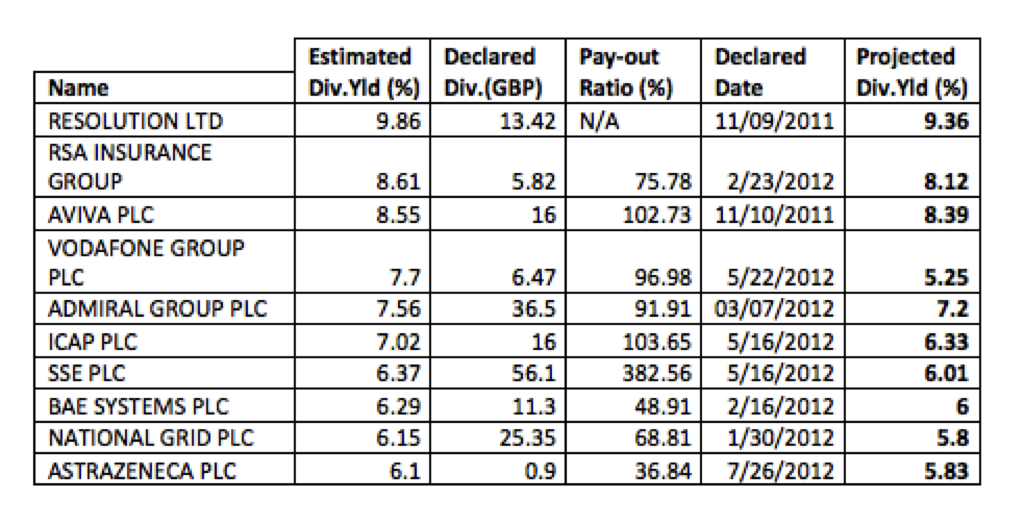

Stock Market investing strategies vary wildly: from investing to make high-risk gains, to investing in lower risk stocks with high dividends. A lot of people forget that stocks can offer attractive dividend yields in addition to making them money upon selling. Consider the following FTSE 100 companies performance predictions from 2012:

Impressive predictions right? Obviously, the dividend yield is largely determined by the financial results throughout the year; however some of the top performing companies are fairly ‘safe’ investment choices. Insurance groups account for a large share in the top ranking predictions and are typically quite stable investments.

Be aware that Dividend Yield is just as important (if not more so) as potential share price growth when investing. At the end of the day, the dividends are what will provide you with passive income streams. Do your research and weigh up the risks of investing in stocks – the above companies beat the return on almost any savings account in 2012!

Investing in Bonds

Bonds are often referred to ‘fixed-rate securities’. Corporations and governments typically use bonds to fund projects and investments. They define an interest rate for the return of your investment and your money is usually tied up for a given length of time. The bond will define the interest rate (also known as the coupon) and when the loaned funds (also known as the principal) are to be returned (the maturity date). The interest rates will depend largely on the duration of the bond and the financial position of the issuer. Typical bonds can range from 90 days to 30+ years and interest rates vary dramatically. Consider the interest rate offered relative to historic trends in the market. Recessions are often cyclic, yet interest rates can be very unpredictable. The longer the term of the bond, (usually) the higher risk the investment. The corporation could go bankrupt, the government in need of a bail-out, or other interest rates could become far more competitive. Do your research and only tie-up money that you know you can do without.

Bonds may be a great opportunity to earn some passive income if you are sitting on a large chunk of money and don’t fancy playing the stock market.

Investing Offshore

We have discussed the benefits of offshore investment before on SavvyScot. In a nutshell, using a simple tax calculator has huge tax advantages for expatriates and those that one day wish to retire to a foreign country. A Qrops pension transfer (Qualifying Recognised Overseas Pension Scheme) allows anyone that is already living abroad (or will be within 6 months) to transfer their pension offshore into a government approved scheme and receive their pension in almost any overseas location. If you are at the stage in life (or will bw shortly) that a pension is part of your passive income, the QROPS offers numerous advantages when living abroad, but most importantly:

- Reduced Income Tax Liability – Offshore schemes have zero tax at source and would only be subject to in-country legislation. If you fancy retiring to the Middle East and not paying any tax – this might be a good option!

- Avoidance of Inheritance Tax – An offshore pension could prevent you from giving up a huge chunk of your net worth to the tax man.

Passive income streams are endless and can be started at any time. From Pensions to Paper Rounds – the only limit is your imagination! Whatever your passive income strategy, you need to make sure that the money you are making is joining forces with you to help you make even more money!

Question Time: What is the BEST investment that you / your friend / someone you know has ever made? How much did they make or what did they get?

I so wish I was generating more passive income. Hopefully this year I will be able to substantially increase it.

Glen @ Monster Piggy Bank recently posted..Giving Gifts on a Budget

I have a feeling that when our book hits all the amazon / itunes / other charts then we can get pretty rich! 🙂

I have invested in my retirement – which I suppose is technically passive income. We’ve also done some investing in CD’s before. However, our biggest source of investment income is in our rental properties.

Greg@ClubThrifty recently posted..Become a VIP Club Insider!

Rental properties is definitely a good one (depending where you live)! 🙂

When the economy sank I bought a house on 5 acres for !0K. Yes…10K…in VT where I live in the summer. The best investment…ever.

Tony@YouOnlyDoThisOnce recently posted..Edit Your Commitments

Wow!! That is incredible…any idea how much it is worth now?

You’ve covered two of my passive investment choices. Shares in the form of Trackers and a High Yield Portfolio (grabbing at those important dividends you alluded to and including VOD, SSE and AZN from your chart). Also bonds in the form of Index Linked Gilts.

The other passive investment classes I also choose to use are Commercial Property, NS&I Index Linked Savings Certificates, Cash and dare I say it Gold.

Cheers

RIT

Retirement Investing Today recently posted..The S&P 500 Cyclically Adjusted PE (aka S&P 500 or Shiller PE10 or CAPE) – February 2013 Update

Hey RIT!

Property Cash and Gold are most definitely on their way in the series! 🙂

I just recently started investing (just mutual funds for retirement), so I don’t have a big investment success to share yet. I’m hoping our condo will be a great investment in a few years.

KK @ Student Debt Survivor recently posted..Flood Your Car to Save Money

Hopefully the condo will start to pay you back nicely! Let us know how the investing goes…

Amen to dividend investing! What a truly passive source of income. I bumped up my portfolio last week and am looking at a potential $1,000 this year. I can’t wait until its $10,000 (or more)!

My Money Design recently posted..Believing In Yourself After Finding Out That You Suck

Sweeet! That is a fantastic return… do you specifically invest for dividend or capital gains or a mix?

Our passive income comes from real estate currently. It isn’t truly passive. There is some work and thought involved, but it has been successful up to this point. I would love to have more in dividend income down the road.

Kim@Eyesonthedollar recently posted..Money Decisions to Make in Your Twenties

I guess another way of looking at it is that it could be truly passive (if you used a Property management firm) but you make extra money by doing that yourself 😀

Your advice is very appealing.