The first step in becoming a successful investor is taking the time to understand the markets and the different types of investment options that are available. There is an element of risk in every form of investment – just as there is in virtually every decision we make in life. Even a basic understanding of how the financial world operates allows a high degree of risk management and the chance to minimise losses and maximise profits.

There are several different ways to invest your money. The most common options fall into three main asset classes; stocks, bonds and short-term investments, Wise investors will usually divide their money between the asset classes as a precaution against sudden losses in one area.

One of the most potentially profitable, but also most risky investments is shares. Buying shares on the stock market is usually the first form of investment that people explore. When you buy shares in a company you are effectively becoming a part owner of that company; its fortunes are directly tied to your own. If the company is successful the value of your shares may rise and you can sell them at a profit. You may also get a direct share of the company’s profits in the form of dividends (cash payments). If the company fails you could see the value of your shares fall rapidly – even to the point where you become a creditor of a bankrupt company.

Bonds are less risky than shares but usually yield smaller profits. The simple principal behind a bond is that the investment is a form of loan to the organisation that issued the bond. The bond is a promise to repay principal with interest. Bonds issued by stable governments are usually a very safe investment – almost to the point of being risk free. Bonds issued by major companies also fall into the lower risk bracket.

Mutual Funds allow small investors to pool their assets under the supervision of financial experts. The money is channelled into specific investments by the fund manager. The advantages of mutual funds include the specialist knowledge of fund managers and sophisticated investment strategies that can yield higher returns. Investors should be aware of hidden charges that can eat into their profits and bear in mind that fund managers are by no means infallible. There is always a potential risk when you entrust your money to a third party.

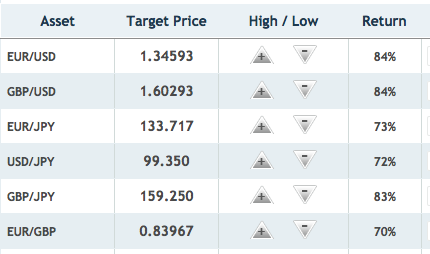

Perhaps the most interesting options for a small investor or newcomer to the markets are alternative investments like forex and binary options trading. Alvexo is a Forex broker that allows you to get a demo account before you actually invest your funds, so you can see how you perform without risk. Binary options also allow a hands on approach to trading, giving investors complete independence and personal control of their investments. The trading platforms are designed for convenience and ease of use and allow a high degree of risk management. The fee structures are also much more beneficial for small investors. Binary options are far more flexible than traditional investments, offering investments with fixed timescales anywhere between minutes and months. Investors are also guaranteed fixed payouts, regardless of the scale of asset performance.