Hello! As you read this I am on a 4-day long weekend trip enjoying some nice rain in Falmouth. Today I bring you a guest post from one of my new blogger friends Andy over at Complete Personal Finance. If you enjoy this post, I recommend checking out some of his other content over at the site. Make sure you check out the different insurance premiums by career – it is incredibly interesting. Have a great weekend guys!

Motorists over the age of seventy are always given a rosier outlook than those who are younger when it comes to the price of car insurance. Insurance price data published by Towers Watson Car Insurance Price Index indicates the first premium drop for over 70s for the first time in many years.

The data points to the overall fall in premium rates across different age groups but by comparison, motorists over seventy are still receiving the lowest rates.

Now before we all starting get excited about falling premiums – it’s still true that the best way to save on your insurance is to find a provider that best suits your individual requirements, and that normally means looking around.

One advantage of getting older

It’s not only the seventy plus category that have seen a fall in premium rates. Car insurance premiums for people in the age group of 61-65 can be as low as £321 and the age group of 66-70 are looking at paying around £342.

Gareth Kloet, vehicle insurance specialist, attributes the reason for drop in premium rates to the increased number of insurance players present in the market place than ever before. In order to capture the market, car insurance providers are trying to attract customers by providing such low rates. Another factor for the falling premium rates for the older drivers is that these drivers are perceived to be more careful in driving and thus resulting in fewer car accidents.

Fall in premium rates across different age groups

The data published also signifies a fall in premium values for the young drivers in the age group of 17 to 20 and those youngsters in the age group of 21 to 25.

The premium rates for the young car drivers in the age group of 17 to 21 has come down to around £2000, while motorist in the 21 to 26 age range face premiums on average of £1126.

Car insurance rates for women

Women in the age group of 17 to 21 pay an, average, annual car insurance premium of £1493, compared £1998 paid by their male counter parts in the same age group. The main reason for this difference in premium rates is that the women drivers across several age groups are less likely to get involved in an accident, when compared to the male counterparts in the same age group. However, that might not last if US providers follow the example set by new European law.

According to this law, the car insurance companies would not be able to fix the premium for women at a much lower rate than men. Insurance companies cannot fix the premiums based on the gender profile of their customers. The overall difference between men and women across different age groups comes to around £100. It is definitely the right time to buy in Europe and the UK and hopefully we can enjoy a decrease in premiums this side of the Atlantic

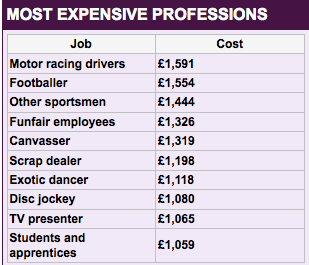

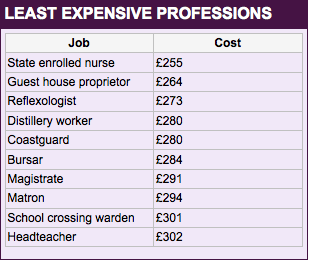

How your career choice influences premiums

Check out the following premiums according to totallymoney:

What are your experiences with Premiums for car insurance?

Amazing how your profession can affect your premium. I had quite different quotes putting different labels on my job, but from now on I think I’ll be a nurse 🙂

Pauline recently posted..9 tips for UK expats

Haha! I think I will join you on the nurse front

I didn’t realise there was such a big difference between men and women – I try to keep mine low by driving less and having an older car. I think my premium for last year was something like $300 for theft, fire and third party property. In Australia we have personal injury insurance built into our registration costs. Nice article!

James @ Free in Ten Years recently posted..Monthly report: October 2012

It is a little bit sexist right?! $300 is a great deal!

Love the table on how different professions are charged – poor scrap dealers: why so high? One other thing I learned about reducing costs of car insurance recently was how much your premiums can fall by if you’re willing to let insurers install a black box in your car. I read about one guy whose premiums fell by 200% cos he got a black box installed! I wrote about it here if you’re interested http://skintinthecity.com/cheap-car-insurance/ And re women drivers, yes our premiums are likely to increase because of the new EU ruling which will no longer allow reductions on the basis of gender.

This used to really annoy me when I was younger. It still does a bit now, but seeing as i’m in the sweet spot of being old and in a fairly stable career, it’s starting to bother me less…

The extra money they make you pay just because you are younger, or male, or a football player. It’s just discrimination plain and simple!

Glen @ Monster Piggy Bank recently posted..6 easy money SAVING tips

Agreed Glen! 🙂

Ugh…I remember when I was a teen 10+ years ago and how ridiculous the car insurance premiums were then. Being 16 and being a male made the prices outrageous! Too bad there are so many immature morons that cause the prices to be so expensive!

I was pumped when I got to 23 and the prices for the insurance dropped significantly!

Jason recently posted..Our Journey Out of Debt – October 2012

Jason – I think you just did the classic … I remember when I was a lad line! haha – it is outrageous the premiums you pay though!

It is pretty crazy how demographics can effect your car insurance. What I didn’t realize is how much your job also changes your insurance. I guess the insurance companies have this down to a science so that they make money and you pay a little as possible to keep you as their customer.

Jason Clayton | frugal habits recently posted..What’s with all the Closing Costs and Fees when getting a Mortgage

Absolutely! It makes you think twice about how you actually define your industry on these forms

I’m an older woman with a boring profession, Yay! Thank goodness I didn’t marry a race care driver.

Kim@Eyesonthedollar recently posted..Rental Property Series: Let’s Drink to Having Tenants

Boring? I think it’s quite cool! 🙂

I had no idea that your profession could affect your insurance rate! I guess the fact that Brian and I sit around on our butts all day at computers is a benefit in this case.

CF recently posted..Paying off $27,000 in student loans

It is quite alarming right?! I wonder who puts these stats together….

it seems that getting older is better to have cheap car insurance….me also has the advantages of that because of i am a woman… 🙂

Absolutely 😉

But only until the end of the year Linda…