Can you believe there are only two weeks left in 2014? I know, me neither. And with the new year, comes the perfect time to take care of your finances! That means cleaning up your financial house, and setting goals for the year to come. And there is a perfect tool to help you do just that. uMoneyBook is a program that allows you to keep track of your finances, and by inputting a number of details, to see your global financial health and where you are heading.

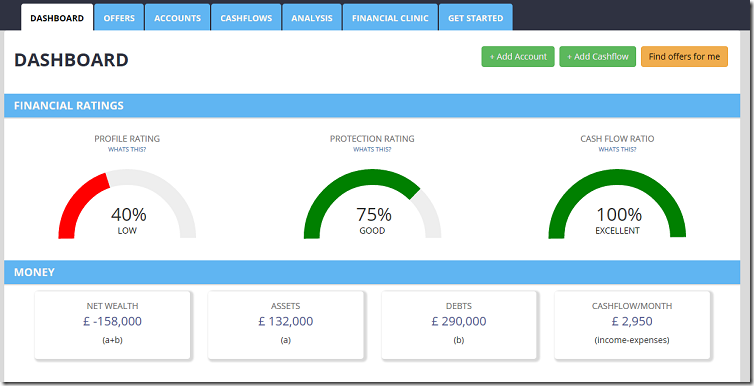

When you create an account and log in, uMoneyBook takes you to a dashboard, where you can see your net worth, which is the difference between your assets and your liabilities, as well as your monthly cashflow, the difference between your income and your expenses.

Based on that, uMoneyBook rates your financial health and helps you improve with a few suggestions, like moving some of your cash to a savings account for example.

In this example, the user has a £2,950 monthly cashflow, which is deemed excellent, but a negative net worth, as they are £158,000 in the red. Part of their monthly cashflow should probably be used to repay the £290,000 of debt they are in, in order to get back to a positive net worth.

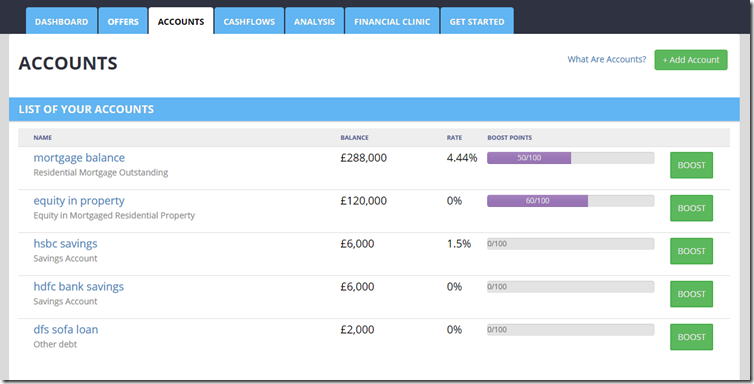

This summary on the dashboard comes from the accounts tab, which lists all of your accounts, savings, mortgage, loans or current account, etc… you have to add them all in order for uMoneyBook to present a clear picture of your finances, and be as accurate as possible.

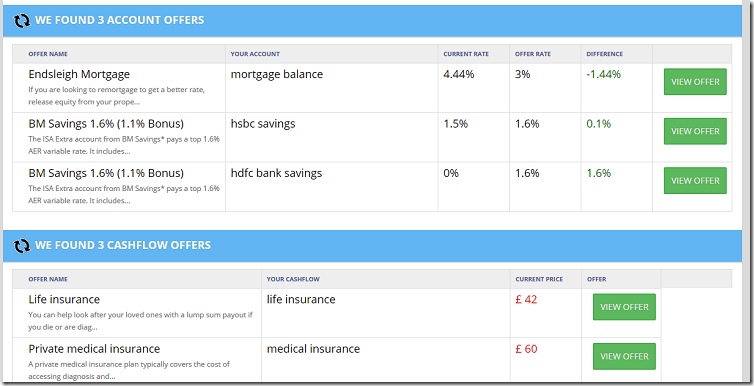

As you also input the interest rate of your debt or your savings account, it allows for easy calculations. Meanwhile, the offers tab suggests alternative accounts to move your money to.

Those offers are similar products to the ones you use, for example savings account paying a higher interest rate than the one you currently have, or refinance offers for your mortgage at a lower rate. uMoneyBook also takes care of your cashflow, by offering some options regarding your monthly payments, such as life or health insurance.

So not only do you get a detailed picture of your finances, uMoneyBook saves you the trouble of having to go through all the price comparison websites and try to find better deals to the financial products you actually use. That can save you a lot of time when doing your financial inspection in the new year. Instead of reviewing each line of your budget, and making sure you get the best interest rate on your savings, and the lowest rate on your debt, just go to the offers tab and find out about it all in one place.

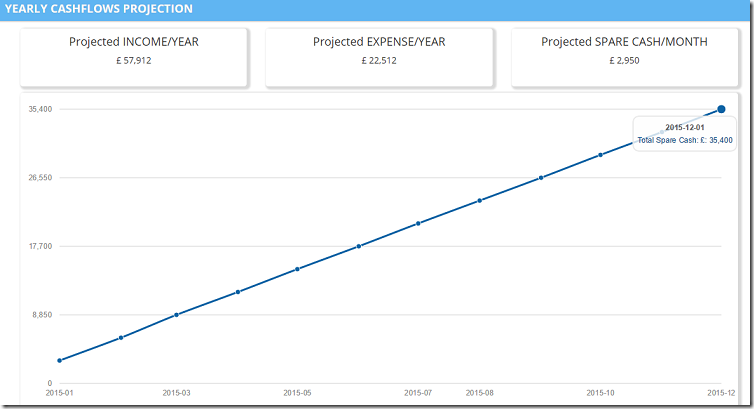

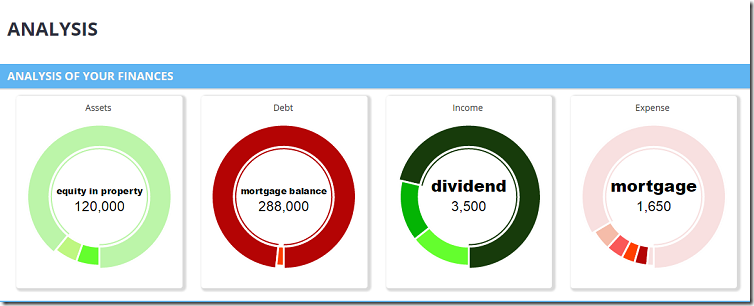

Next, there is an analysis tab with cool charts of your projected cashflow if all things remain the same in the new year. Hopefully, your income will grow and your expenses will lower!

there is also a 3 month analysis of your finances, and pie charts to see where your money is as part of your net worth, and where your money is spent every month.

And to help you get started, there is a step by step guide to make sure you make the most of uMoneyBook. So let’s enjoy the new year as a time to get our finances in order!

Sounds like a great way to track your finances! This is something I need to work on for 2015.

Michelle recently posted..10 Ways To Squeeze Side Hustles Into Your Busy Schedule