When I tell people I am going to live until age 93, it makes them laugh. Why 93? Well, with the average life expectancy in the high 80s, I thought my low risk lifestyle would buy me a few more years. My grandparents are 88 and 90 and going strong. They drive, climb stairs and even volunteer. So 93 doesn’t seem too far fetched. It’s more, I have read that the first human to live to 150 years of age might be born already. And did a couple of (completely informational) online tests recently, inputting data about my exercise, nutrition and alcohol consumption, and got a result saying I had a 25% chance of living to 100. A big enough probability to ignore.

Why are we talking about this again? Because all those extra years of life will cost money! Hopefully, with good health, not too much money. My grandparents live in a paid for house, they’re pretty much homebodies who aside from their food, cars and tithing don’t spend a whole lot of money. But how about needing assisted living facilities in old age? The affordable ones go for around £3,000 a month these days! Factor in inflation at 2% a year, and we are talking £8,000+ a month 50 years from now!

That is why most people doing retirement calculations use a 4% withdrawal rate for their savings in order to find out how much cash they can count on in old age. 4% is considered a “safe” withdrawal rate, that will allow your nest egg to outlive you, instead of saying “I’ll have a million in retirement, and I’ll withdraw £50,000 a year for the next 20 years”. What if you live 30 years?

So in order to have a nest egg providing £96,000 per year to cover a £8,000 a month nursing home, at an annual withdrawal rate of 4%, you need £2.4M for retirement. That means you need to save £1,350 a month for the next 30 years, if you are expecting a rate of return of 8% per year. Scary, I know.

And yes, now is the time to get started. In your 40s and 50s, you will probably have a bigger house, some kids who need clothes and tutors, tablets and band camps, and then they’ll be off to university and they’ll need rent and tuition money. It never stops. The more you grow up, the more your expenses grow. It’s called lifestyle inflation. So invest what you can now, and try to grow your monthly contributions a little bit each year with your salary increase.

Even if you only start with £100 a month, you can still build a nice £150,000 nest egg for retirement, based on 8% returns and a 30 year timeline.

So how do you get started with investing? Luckily, it is getting easier these days, thanks to robo advisors such as Wealthsimple.

Reader offer: If you use the link at the end of this post, you can get your first £10,000 managed for free for a year.

Wealthsimple is a Canadian company that is operating in the US and the UK as well, and offers simple solution to start investing now. You just need to register, answer a few questions to help determine what kind of investor you are, and choose an initial amount to invest. The pricing for their services is pretty transparent, at 0.7% a year if you invest under £100,000, and 0.5% over that. Their second tier, called Wealthsimple Black, also an investment planning session with one of their advisers, and VIP access to airport lounges all over the world.

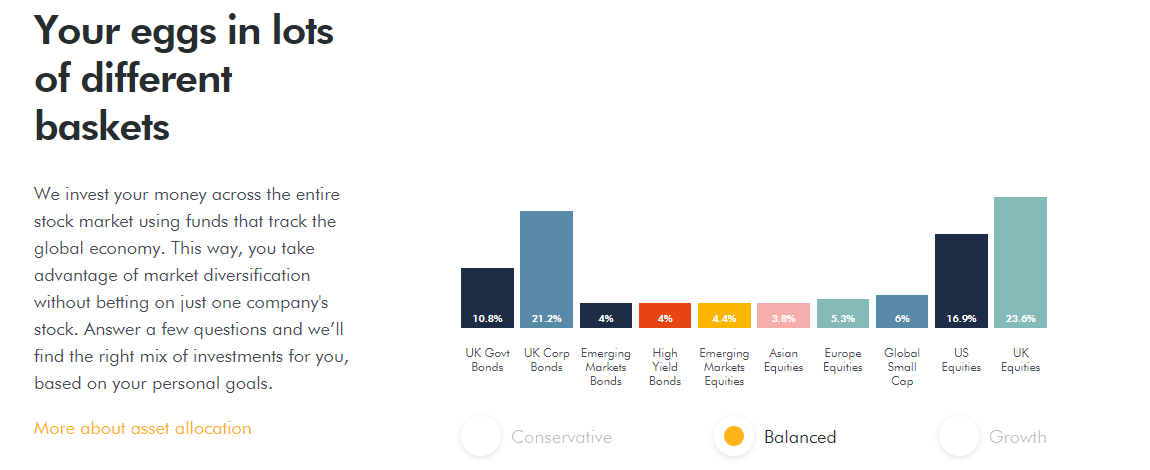

Depending on your investor profile and risk aversion, Wealthsimple automatically allocated your investments in bonds and equities. The amount allocated to each one changed according to the Conservative, Balanced or Growth strategy.

Wealthsimple also has a socially responsible investing feature, that allows you to invest with the same low fees, but targeting companies that are socially responsible, for example companies using cleantech innovation or committed to fair labour policies.

Your portfolio will be spread between UK government bonds, shares in clean energy companies, ETFs that hold shares in ESG leading companies, and sustainable bonds.

In three years, Wealthsimple has been trusted by over 50,000 investors and now manages over £1Billion in assets globally. You can fund your account through BACS or debit card. The easiest way to get started is to open an Individual Savings Account, or ISA, if you haven’t done so this tax year. ISAs allow you to invest up to £20,000 tax free, before April 2019. If you already have a cash ISA, you can invest the difference between your balance and £20,000 in your Wealthsimple ISA. All capital gains will be tax free for as long as you keep your ISA open. You can also transfer ISAs from previous tax years, and keep earning tax free gains. You should talk to Wealthsimple before transferring your balance, as you cannot cash it out then reinvest, or you would lose your benefits!

As usual, remember that with every potential gain there is an associated amount of risk. Markets go up and down, and you should invest money for the long term, money you can afford to lock up for a few years at least, or you may need to cash out on a market dip, which is never a good option.

Click here to start investing with Wealthsimple