If you’re looking for an effective way to save for a brighter future, an ISA is a generally a great starting point. ISAs, or Individual Savings Accounts, can help you reach your long-term financial goals quicker than a standard savings account with your high street bank because you don’t have to pay tax on any interest earned or capital gains you might make. The ISA allowance for the tax year upto 5th April 2015 is £15,000, rising to £15,240 for the next tax year, from 6th April 2015. The only question remains – how can you get the most from your ISA allowance? Let’s take a look at your options.

Use it or lose it

You must save or invest by 5 April (the end of the tax year) or else you lose that year’s allowance – forever. Any unused ISA allowance cannot be carried over to the following year. With the new ISA rules you can put all of your allowance into a cash ISA, invest the whole lot in an investment ISA or split your allowance between cash and stocks and shares ISAs in whichever ratio you wish. If you take your money out of an ISA it loses its ISA status and all the associated tax benefits – and you can’t put it back in again later.

Cash, stocks and shares, or both?

In order to get the most from your ISA allowance, you should consider your financial goals. If you’re a seasoned investor, you’re probably inclined to use your full ISA allowance on a stocks and shares ISA as you’ll most likely be comfortable with investment risk and reluctant to make-do with the low, fixed interest rates you typically get from a cash ISA. But if you’re anxious about investing and want the assuredness of a fixed return, no matter how low, then a cash ISA might be more up your street. Or you can split your allowance between the two in whatever ratio you wish.

If you do opt for the stocks and shares ISA in a bid to yield higher returns there are many investment management services out there that can help you make sensible financial decisions. Let’s take a look at some of them.

Nutmeg

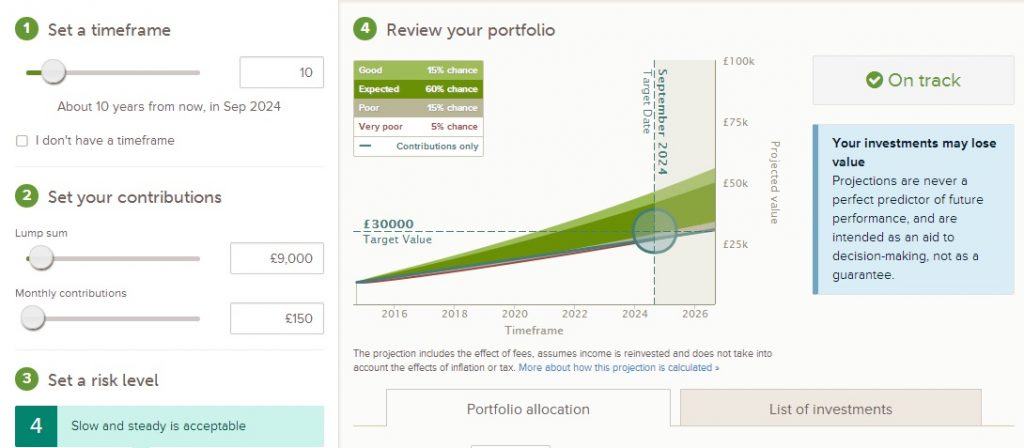

No two investors are the same. While some are comfortable taking a high risk approach in exchange for the lure of higher rewards, others will feel safer adopting a low-risk strategy. This is why Nutmeg tailor their investment services appropriately. If you open a stocks and shares ISA with this multi-award winning company, for instance, they will create an investment portfolio based on the type of investor you are, from low risk (portfolio 1) to high risk (portfolio 10). They have a team of investment specialist monitoring the markets to seek out opportunities for good returns on your behalf, regularly adjusting your investments to help keep them on track.

You can start a Nutmeg ISA with as little as £1,000 and the set-up is quick and easy. They also have a personal pension.

Here’s what some of Nutmeg’s customers have said about the service:

- “They give me absolute trust that they’re on top of my finances — as much as I would be if I was managing it.” — Helen, managing director

- “Nutmeg have taken away the burden of managing my money. I feel safe. With Nutmeg, I have an expert investment team.” — Fergus, chartered accountant

- “It’s much more convenient, much more accessible, and much more transparent.” — Andrew, company president

- “I don’t see the value in independent financial advisers. I don’t have time to stay on top of the markets. So Nutmeg is the perfect solution.”

Charles Stanley Direct

As one of the leading investment management companies in the UK, Charles Stanley Direct offers a simple and efficient way for private investors to get involved with the stock market. This award-winning platform has made a name for itself within the financial sector for making investments affordable offering a range of stocks and shares ISA with no initial charges or additional annual fees. Clients can enjoy an array of advantages such as commission-free fund pricing and automatic “clean” conversion of fund transfers (where possible) coupled with the tax benefits of an ISA account.

Here are some customer reviews of Charles Stanley Direct:

- “For ISA and Investment Accounts with regular contributions the 0.25% charge makes it an attractive proposition especially against the Hargreaves charge of 0.45%.”

- “Charges are so low that investing with Charles Stanley Direct is typically the cheapest means of investing in popular funds.”

- “The charges are very clear.”

Brewin Dolphin plc

Brewin Dolphin plc, is one of the largest British investment management and financial planning firms with 39 offices throughout the UK and Channel Islands. With £28 billion under management, they’re well-known for their exceptional service which includes tailoring ISA investment portfolios to suit you wants, tastes, needs and attitude to risk. The discretionary management service offered is both an attractive and convenient solution for anyone without the time or inclination to take an active role in managing their investments, so here’s what some of their customers had to say:

- “Brewin Dolphin has a lot of experience and good systems and controls.”

- “Brewin Dolphin offers excellent reporting.”