April 15th – the day that makes most of us shudder. Dealing with taxes can be a complicated process for the average person, but investors have an even trickier time staying in compliance with the IRS tax code.

While online programs like TurboTax, for example, might be a good fit for someone with straightforward financials, traders risk being audited for withholding information. Don’t fall pray to common filing mistakes.

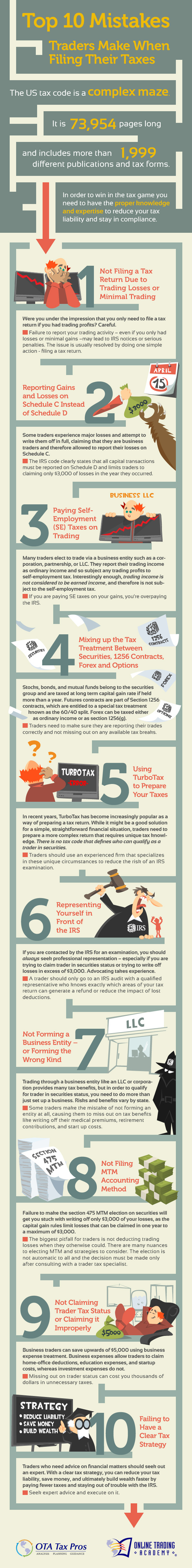

Check out the infographic below for a list of the most common downfalls for traders and casual investors and learn how you can build the ideal tax strategy to prevent an examination of your finances by the IRS.