One of the biggest challenges when it comes to sorting your finances is trying to understand and track all your income and outgoings. Most of us have multiple online portals: Perhaps a couple of banks, credit card companies, investment companies, energy companies, tv, broadband, mobile phones etc. This leads to dozens of credentials and a general hassle when it comes to logging in to see balances and transactions.

Personally, this frustrates me. A LOT! At home, we have a process where once a week we log into each account and check our balances. The two main reasons we do this weekly is to ensure that:

- No fraudulent transactions have occurred (paranoid much)

- To track spending and make any necessary adjustments

We then transfer all this information into a master spread sheet which tracks spending categories, bills paid and overall net worth.

Spending: What to Track

For me, the trick in keeping expenses down lies in what you do with the data. We can all look at our bank statements and scan a list of restaurants, coffee shops and pubs and think little of it. Only when we start to categories and total these expenses – represent them as a percentage of our overall income – do we realise their significance. A Pie Chart speaks volumes… (literally)!

Spending tracking is quite a personal thing – we all have our unique weaknesses and we all know where we need to watch our cash. The classic examples of this would be spending too much money on coffees or takeaway food. A few pounds/dollars here and there goes unnoticed, but the monthly spend is actually huge! For some the downfall lies in shopping for unnecessary items, for others it is fancy cars and mortgages that they can’t really afford. We are all different, we all have different interpretations of what is acceptable to spend money on. Regardless of what you think your weaknesses are, it is important to track all categories of spending. Here are some of the items from our spread sheet:

| Clothing |

| Entertainment |

| Dining/Eating Out |

| Movies |

| Other |

| Sports/Recreation |

| Groceries |

| Insurance |

| Auto |

| Homeowner/Renter |

| Health |

| Life |

| Other |

| Loans |

| Auto |

| Home Improvement |

| Home Equity |

| Other |

| Student |

| Mortgage Payments |

| Medical/Dental Costs |

| Outgoing Payments or Transfers |

| Mobile Phone |

| Home Phone |

| Retirement Savings |

| Subscriptions |

| Utilities |

| Cable |

| Gas and Electric |

| Internet Access |

| Other |

| Water |

If you are new to Personal Finance and don’t yet track spending…. now is the time to start! Obviously you can customise the above to meet your own needs; perhaps you don’t want to go into as much detail, or perhaps you don’t want to track the constant expenses in the same way. Tracking at least some items is certainly better than tracking nothing!

Using Technology to Track Spending

My friends across the pond are familiar with the success of MINT – a tool that enables you to connect multiple online accounts to a single portal. Essentially, the technology securely reads the balances and transactions in your accounts and displays them all in the once place – a convenience tool! I was always quite jealous that we were unable to use this in the UK, until I recently discovered a new company called Money Dashboard.

“Whoever you bank with, all your accounts come together giving you a clear picture of exactly what’s happening with your money.”

I am a great believer in this new Technology and strongly believe that the easier it is for people to check their account balances and recent purchases, the more responsible they will become with money. I think half the problem with the nation’s financial problems is ignorance… the fact that we are all unaware on how much we are spending and the effect that this has on our finances! What’s more, there are some fantastic mobile versions of these tools available to use on-the-go!

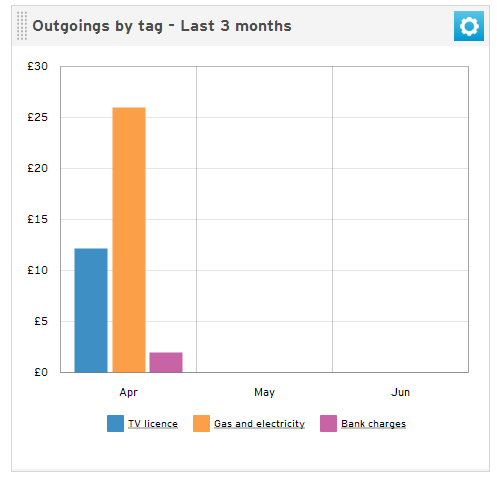

Money Dashboard offers the opportunity to tag each line of your spending to see exactly what you spent in each category. What a great way to stay in control of your finances!

SUPERmarket Spending

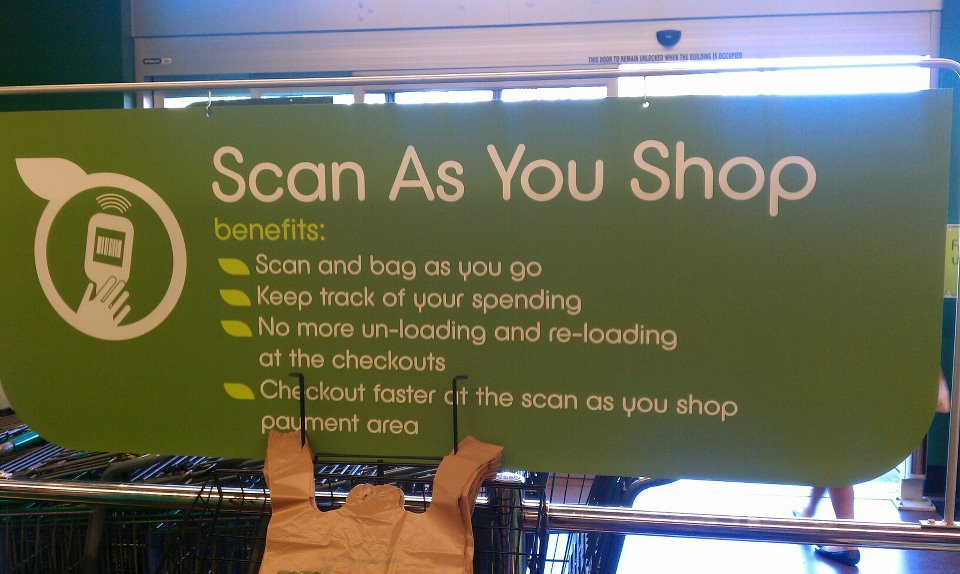

A major British supermarket has done something similar recently, by introducing self-service shopping; you are issued a scanning device upon entering the store which has an on board computer and display screen that tracks spending and offers. No more shocks for shoppers when they reach the till and realise how much they have spent and gone are the days of an attendant at every checkout… Win-Win situation!

I must admit, I am glad that Technology is finally being used to help people with their finances!

Over to you guys… Has anyone linked their accounts? How do you track spending on the go.

We use Mint.com to track our finances and love it!

Hey Deacon! Pleased to hear you are keeping up-to-date with the Tech 🙂

I love the scan as you shop idea! It’s great for mathophobes like me! You know I keep trying things like technology and apps, but I always come back to paper and a simple excel spreadsheet. Everyone is different that way!

Fair enough! I think the Scan and Shop idea will go viral in time… it really makes sense rather than have somebody manually scan all your items. And you are right – it is great for those who are not great with numbers!

I recently made the switch to YNAB, it doesn’t track expenses automatically like Mint does but it sure beats the paper and pen method.

Hey Remy! … Automatic tracking sure helps the lazier side of us all! 🙂

I track every penny I spend the old-school way: entering everything into Excel! Granted, my spreadsheets are auto-linked to charts and graphs, but it’s still pretty standard.

I think the act of recording everything forces me to see the big picture, which helps me keep myself in check.

Hey! Sounds like your method works pretty well then if you are still going with it! Love a few graphs that automatically update! I always feel so productive. I am with you on the thought that constant recording and reviewing helps to keep the big picture in mind! 🙂

I don’t track spending on the go. I feel it beats up the issue and becomes deeply exhausting. I budget, and whatever I have for that budget in a bi-weekly period I make due with.

Hey Eddie. That sounds like you have a decent method that works for you… I reckon that some people aren’t that disciplined though and need to track things more vigorously to ensure they stay within their limits. Do you use a spread sheet to budget then?

I use a spreadsheet. Fill all my numbers in by hand, no computer. I’m kinda old school when it comes to that. I suppose it’s the whole feel, and I carry the spread sheet around until next pay (bi weekly) – so the spread sheet is divided into two parts – fixed and variable expenses for 1 pay check and 2nd paycheck in a month.

Not long ago i produced the change to YNAB, the item doesn’t trail expenses on auto-pilot just like Mint will however it certain defeats the papers as well as put in writing approach.